The Rest of the Week

Top Ideas from Uncharted Territory. November 4th, 2025

Good Evening or Good Morning depending when and where you are reading this! We started this newsletter to provide organized insights for folks like you that want further information and ideas about the market. We aim to provide that here for FREE. We do a lot of work in the discord community, live on zoom and in our respective channels. This is a sneak peak into some of what we do. Probably 5% of it to be honest.

Throughout the morning and afternoon Bracco and TSDR are live on zoom sharing their screens and discussing the market action. Each of us have our own channel in discord where we share what we are thinking and doing. If you are interested in further insights and joining a community of 550+ dedicated traders, take a look at the links below!

If you’re interested in joining us take a look at our Whop page.

Click here and use code “SUBSTACK for 15% off forever.

Highlights from last week’s post!

MDB +14%

SEI +12%

TSDR Trading - WGS APPS

Thoughts on market: Since 10/10 Tariff headline and especially since market breadth has weakened I have had a bit of a tougher time getting traction. I have taken stabs at good spots and good stocks and have had mixed results. Getting stopped out of positions for 2-3%, taking winners from +7-8% back to breakeven, or just no movement and cutting flat by EOD without immediate feedback or cushion. Guess what? That is completely fine. It is telling me to be selective, slow down, and focus up. Rewards from any and all activity have waned, and damage from over activity has increased. There are periods in the market where choosing not to do something has just as big of an impact as choosing to do something. I will not succumb to pressure and fomo and I will focus on my watchlist, relative strength, strong groups,

earnings gappers, and support levels. When the market gets trickier and I shift away from my core and fundamental long term process oriented goals the results are negative. Every time I stick to what I do best and dialed in on MY process, the results are positive. This is my plan.

Now into the ideas!!!

TSDR TRADING - WGS APPS

WGS (GeneDX Holdings)

Healthcare area of the market has been an area of interest for some time and this has acted very nice since earnings last Tuesday. Building tightly in the range and above this base. $134 is hourly support and $142 a level to clear. I will be looking for spots to get in for minimal risk. The weekly is also coming out of a 2.5 month high tight flag following a 120% move since June. TXG another similar name that looks attractive.

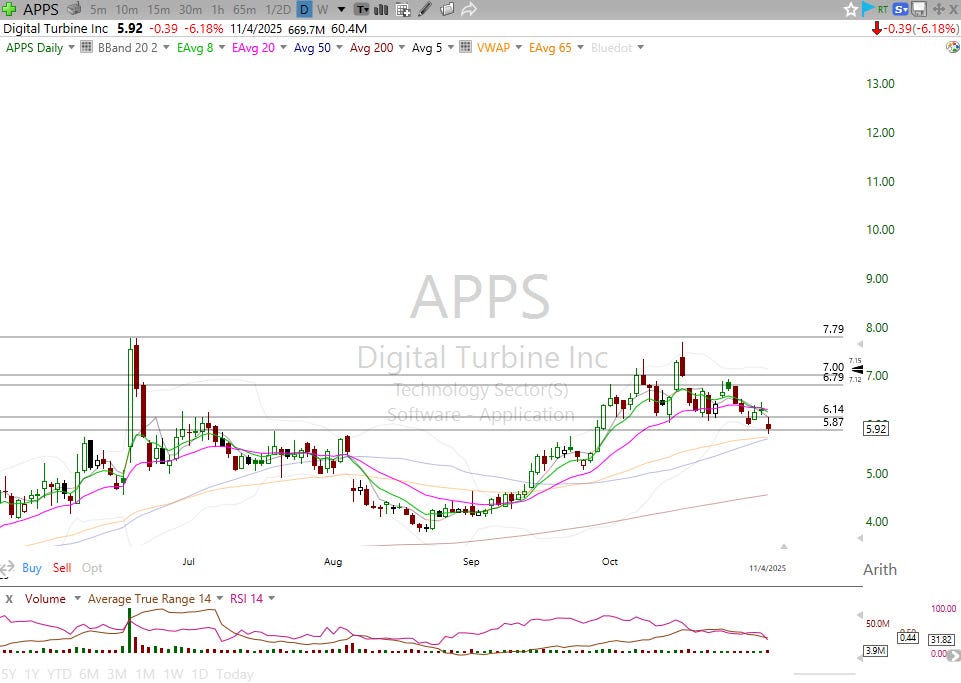

APPS (Digital Turbine)

This is a very simple and straightforward setup. This is gapping up on earnings after a beat on EPS, Revenue, and raising guidance. I will be looking for an Opening Range Break or a “VWAP undercut and rally”. I I like the weekly potential if this breaks $7.50 and $7.80. If we have a strong day tomorrow and it provides an intraday entry post earnings I think this could be a multi week runner. Market depending of course and that is critical to add as an Asterix. Post earnings setups will have some immunity to the market but ultimately the market is in control at all times. Stock currently $7.11 at time of typing this.

Bracco - ETHA ETHU

ETHA / ETHU (Ethereum ETF’s)

Felt like first real capitulatory day in crypto land following recent breakdowns with (at lows of the day) ETH -15% & BTC -7%. Today, ETHU (Ethereum 2x ETF) traded its highest volume ever while ETHA traded its 2nd highest volume ever. ETHA nearing the 200ma and BTC obvious 100k level. Think potential rubber band / capitulation long setup here for a short term trade opportunity. ETH already puked a few % more in the after hours and nearly hit $3,000. Could have bottomed already but want to keep this idea on the radar either way. If indexes get continued downside this week think we could see ETH / BTC re-visit todays lows for a double bottom or potential undercut and rally, wiping out any dip buyers from today. Might be asking for a lot but given recent environment really trying to be picky and just focus in on the best setups. Any sort of bigger move lower to sub 3k on ETH and sub 100k on BTC will be in play for a capitulation long.

Manrav - WU TSLA

WU (Western Union)

Showing Relative Strength and forming a normal flag after earnings. Watch for the 8.7 level to hold or a push and hold of 200 SMA to get long.

Options flow: Seeing some good buying into Dec 9c (8k OI) and 10c (60k OI) and Feb 26, 10c (62k OI) .

TSLA (TESLA)

Remaining the top focus for me. Want to see the 21 EMA hold or an undercut and reclaim is even better to get long/add to the position. No interest below 21 EMA in the short term (if you are a swing trader), but a must have on your watchlist as the longer term chart is positioned for a big move, once the market cooperates.

ChartMaster - LDOS NXT

LDOS (Leidos Holdings)

Weekly cup and handle at ATH’s. Put in a new ATH today on Earnings Beat and Raise. Daily showing a neat little handle testing resistance. Needs to clear psych level 200 to get going.

NXT (NexTracker)

Flag setting up post earnings. After a beat and raise this one is holding the bullish gap after making the pivot today. Starting to build a range and setting up for blue skies.

Alex Jones Industrial Average - BTC CEG

BTC (Bitcoin)

Long idea invalidated with a daily close below $100k psych level. Bitcoin has experienced a 20% drawdown from the highs back on October 6th. These drawdowns are common with this asset and typically represent short term/long term buying opportunities. $100k also acted as massive support multiple times back in June. Additionally the 50 week moving average has supported price this entire move up as well.

CEG (Constellation Energy)

Sitting at a precarious uptrend line and looking vulnerable before. This name rarely sees actionable flow, but 11/28 $350P seeing $300k in premium today and 5/15/26 $350P also seeing $600k in premium. Note this name reports earnings Friday morning in the AM.

Jersace - UUUU

UUUU (Energy Fuels)

If you liked the idea in the mid 20’s, you should absolutely foam out the mouth / love it at 17. UUUU still has an absurd amount of active OI being carried over + the gov’t needs of our own rare earth / uranium deposit for nuclear power. Albeit the 1-year access deal with China, we must begin looking forward. A gov’t stake seems inevitable and most people have already dismissed this trade as a result. Perfect storm for the surprise investment at a now discount from Government.

June 2026 20 calls and log out. See you next week.

Beebe - RKT

RKT (Rocket Companies)

Earnings out of the way I am looking for this stock to re-take the 21 EMA on the weekly/daily. Can risk to this week’s low of $16 building out a position around $17.25-$17.50 for a potential move higher in the coming days/weeks.