SUNDAY SCANS

August 24th, 2025

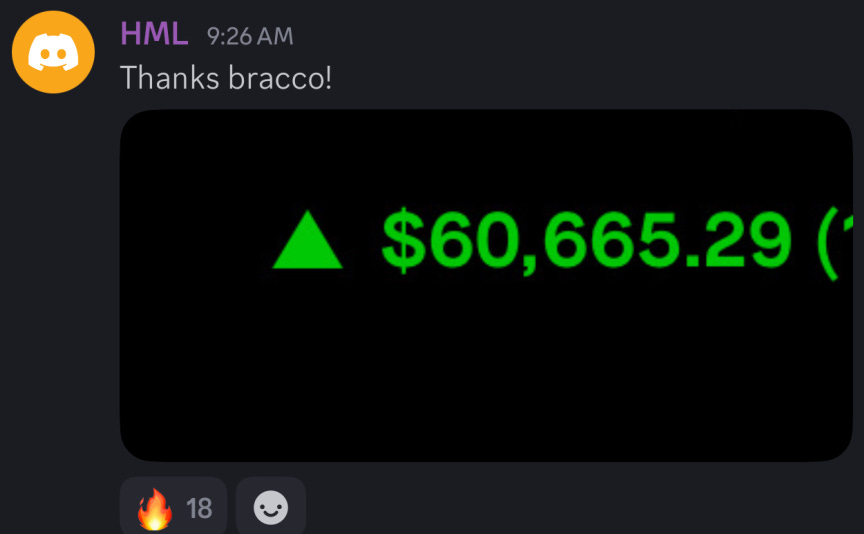

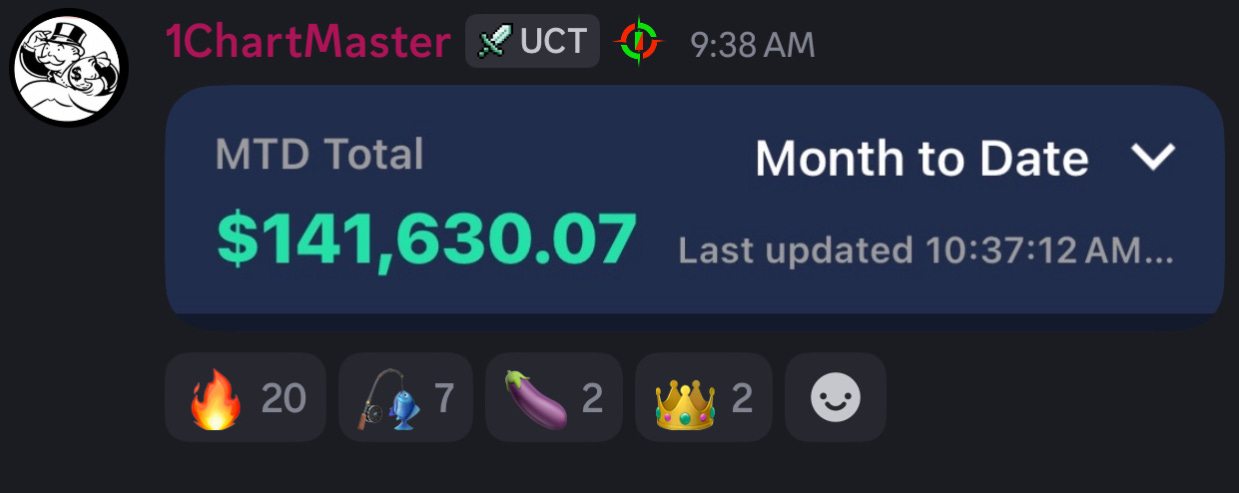

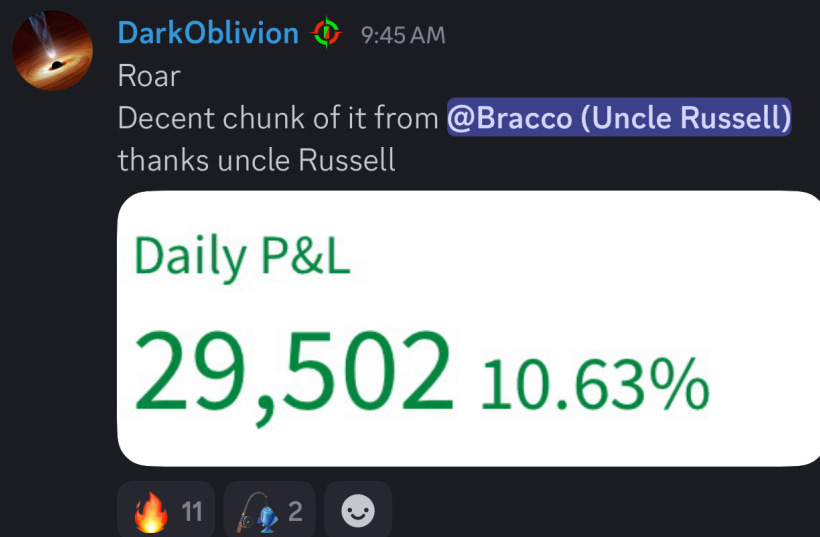

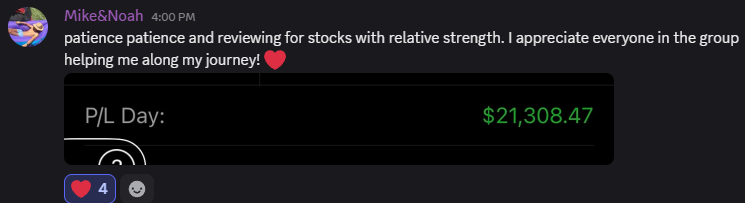

This week was a great example of staying patient and ready to hit your stocks at the right spots at the right time. Many members had record days and record weeks thanks to the explosive Friday action. Just a testament to the focus, patience, and skills we attempt to build in Uncharted Territory. SHRED!!!!

Make sure to check out the GIVEWAY down below for Substack readers.

Want live commentary, alerts, access to Bracco & TSDR, and a strong community of 400+ committed traders?

Go to our website and check us out! Use code “SUBSTACK” for 15% off forever.

GIVEAWAY

If this post gets 50 Restacks & 50 Likes then we will giveaway One Annual Membership access to the Live Trading Discord Server. If it gets 100 Restacks & 100 Likes we will giveaway THREE annual memberships to the Discord! (current members can win too)

NOW LET’S GET INTO THE ANALYSIS

WHAT WE WILL COVER

-Schedule for the week of economic data and earnings

-Market Breadth Data, Internals, and Seasonality

-Index and ETF Analysis

-Bracco’s Breakdown and Top Ideas

-TSDR Weekly Outlook and Watchlist

-Broader Scan List

-Closing Comments and Mindset

Go to our website and check us out! Use code “SUBSTACK” for 15% off forever.

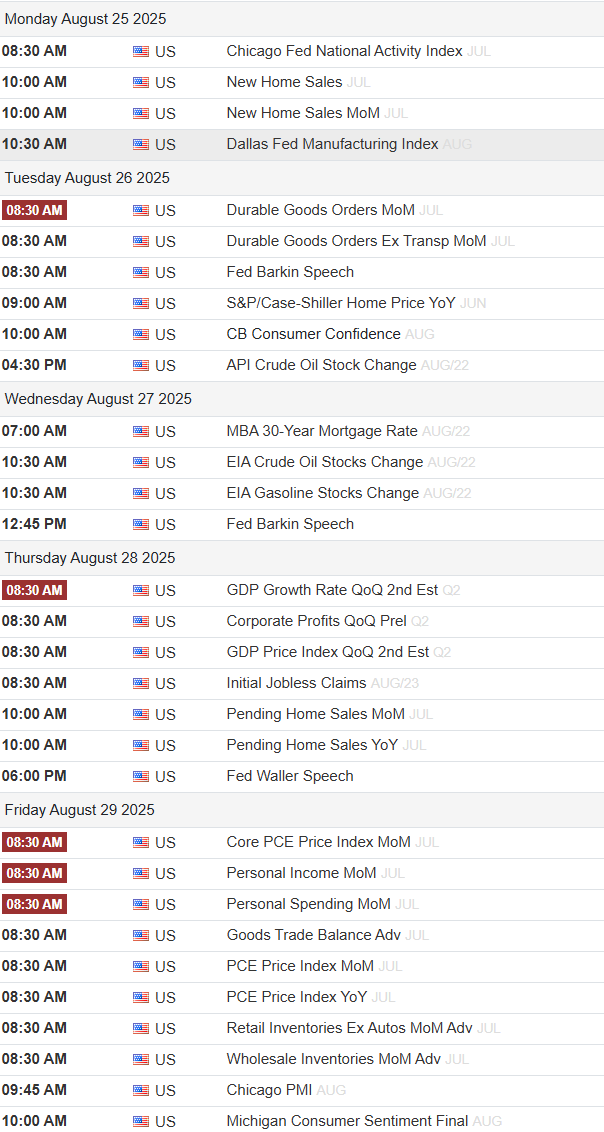

Earnings & Economic Calendar for the Week

Market Breadth Data & Seasonality

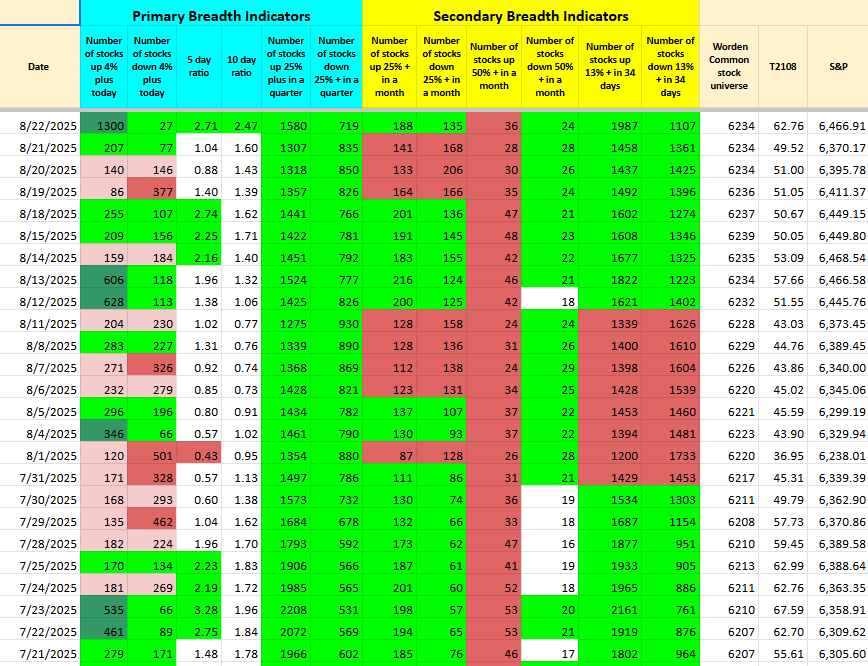

StockBee (Pradeep Bonde) Market Monitor

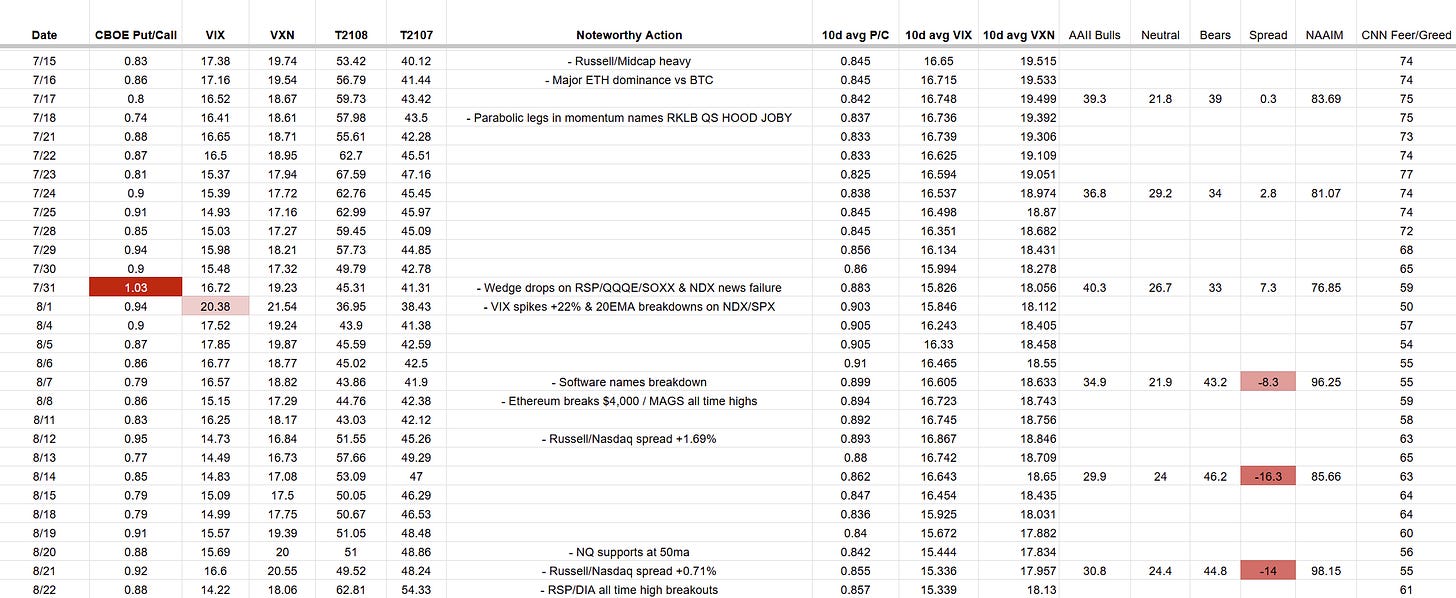

Bracco’s Market Health Tracker

T2108 (% Stocks Above 40MA) = 62.81%

T2107 (% Stocks Above 200MA) = 54.33%

NASI

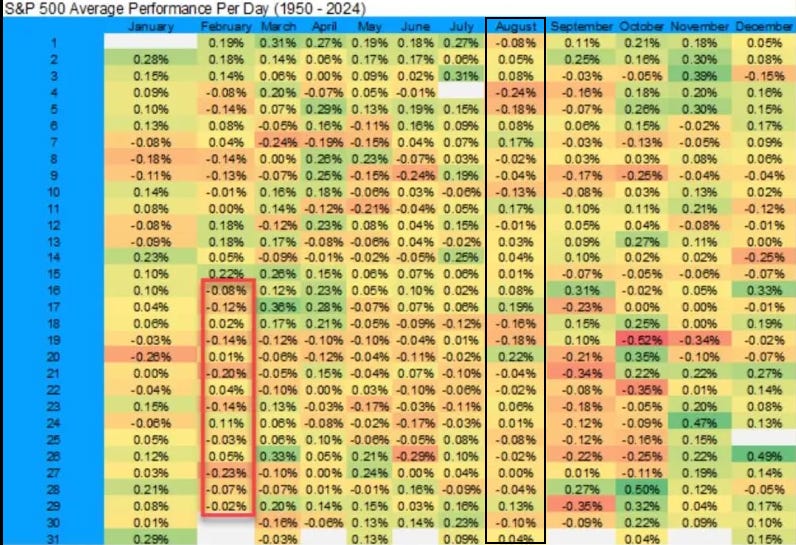

Seasonality

Index & ETF action, hourly levels, and insights for the week ahead

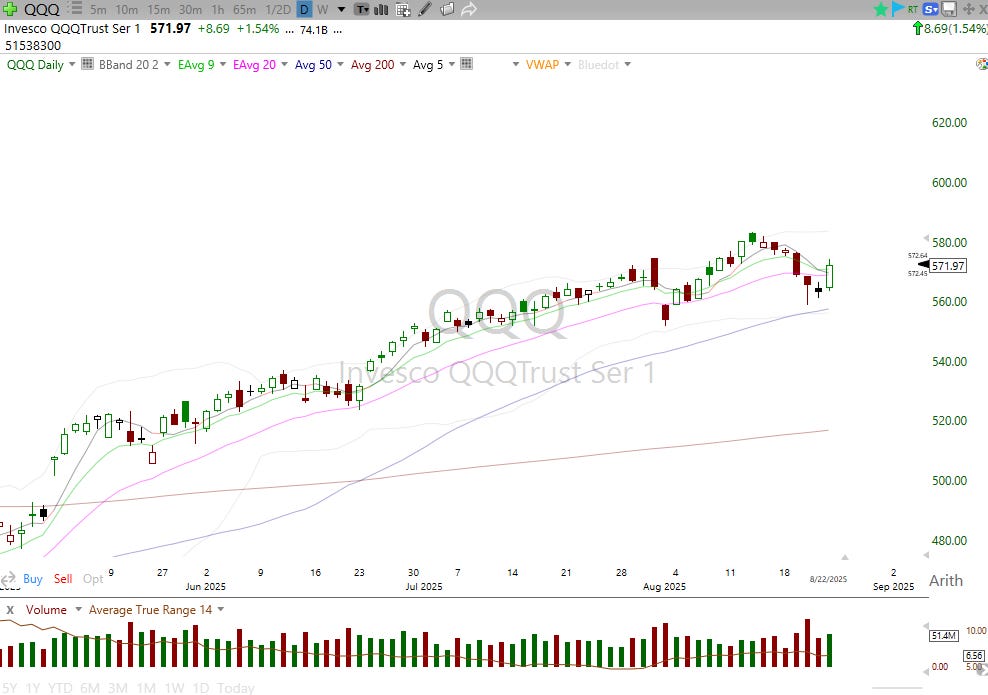

QQQ (Daily Chart)

Range bound or Remount? I cant lie, I could see this shaking out one more time and officially hitting the 50SMA in the coming days and weeks. That would be pretty challenging. However, right now we don’t major reason to expect that. I am leaning towards remount and higher low and a push to all time highs again. My shift near term has shifted a bit away from QQQ and will be watching DIA IWM MDY RSP quite a bit for signal. With the six red days in a row we will have to see if this makes a lower high or if it able to build out for that push to highs. If we maintain the flattening 20EMA then expectation would be immediate continued strength. If we lose Friday’s low next area would be the 50SMA. The lower wick on Wednesday was the first touch of the weekly 9EMA since the April lows and it is very positive to see that hold and a strong reaction.

QQQ (Hourly)

Over $576.75 will gain significantly more confidence in the Nasdaq, not that I don’t have confidence but mindful that we COULD be putting in a lower high. Remounted all MAs coming off six red days in a row. Overall, as long as $563 holds we are good to rely on our watchlist, positions, and general look of stocks to take signal. $574 zone could turn prior support into resistance but that is not my bias right now.

ARKK (Daily Chart)

Classic 1 tap 2 tap 3 tap tight tight tight and ready to blast setup. Ideally seeing some tightness under $78 spot is ideal but with TSLA looking primed this could just push right to $90 quickly. We got the 50SMA test we were looking for coming into the week then Thursday rest and Friday broke the pivot after J HOLE. Want to see Friday’s low hold and can build into trade with expectation of $90 being hit. ARKK has been a monster and going back to May we have highlighted phenomenal spots and direction on this.

RSP (Daily)

Equal weight S&P500 ETF hit fresh new all time highs for the first time since November 2024. A very clean and clear breakout and we have a line in the sand for the market with Friday’s low and the bullish open gap to risk against broadly. With Equal weight ETF, DIA, small caps, and Mid caps breaking out on top of the T2107/T2108 sitting around 50-60% is very exciting and makes my expectation positive for continued participation and performance.

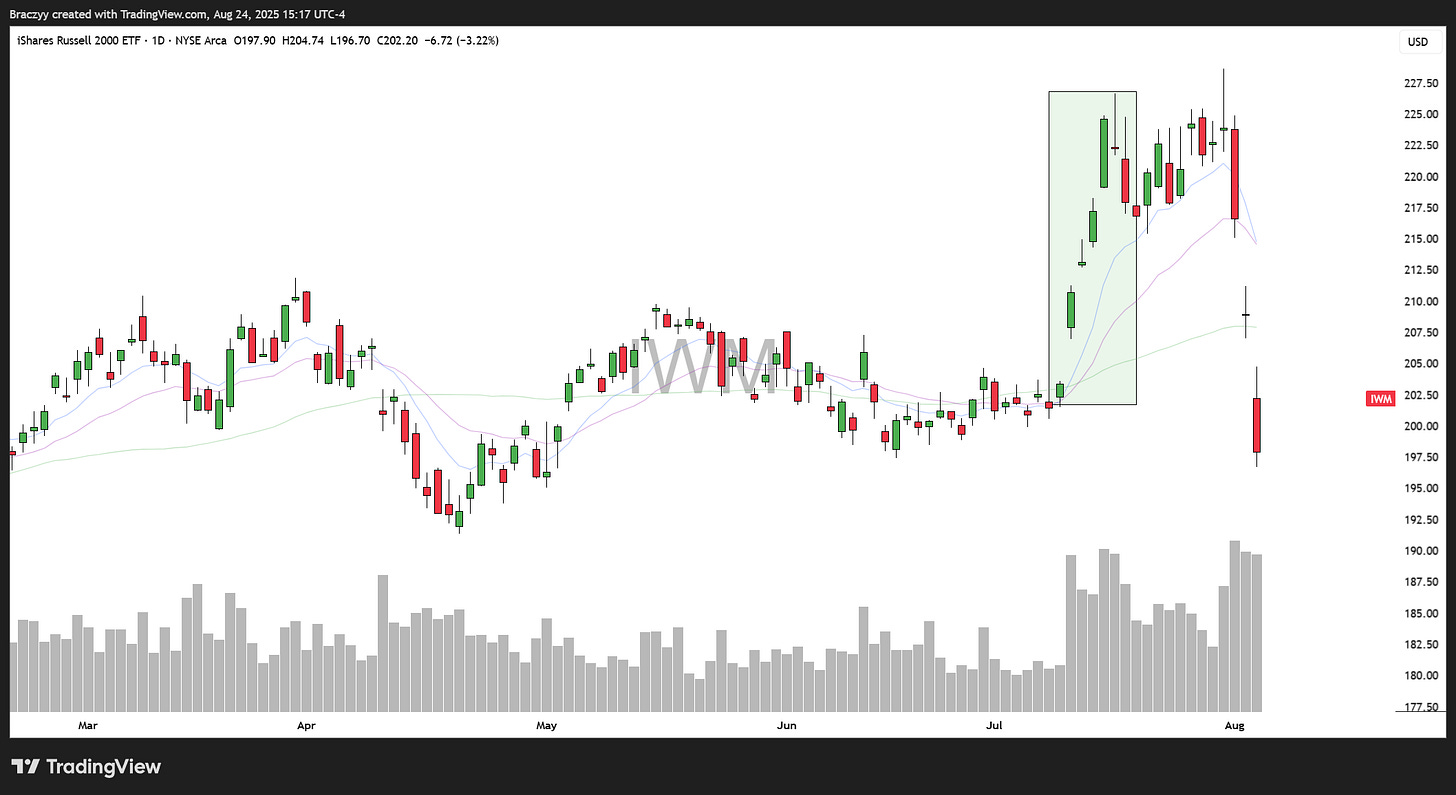

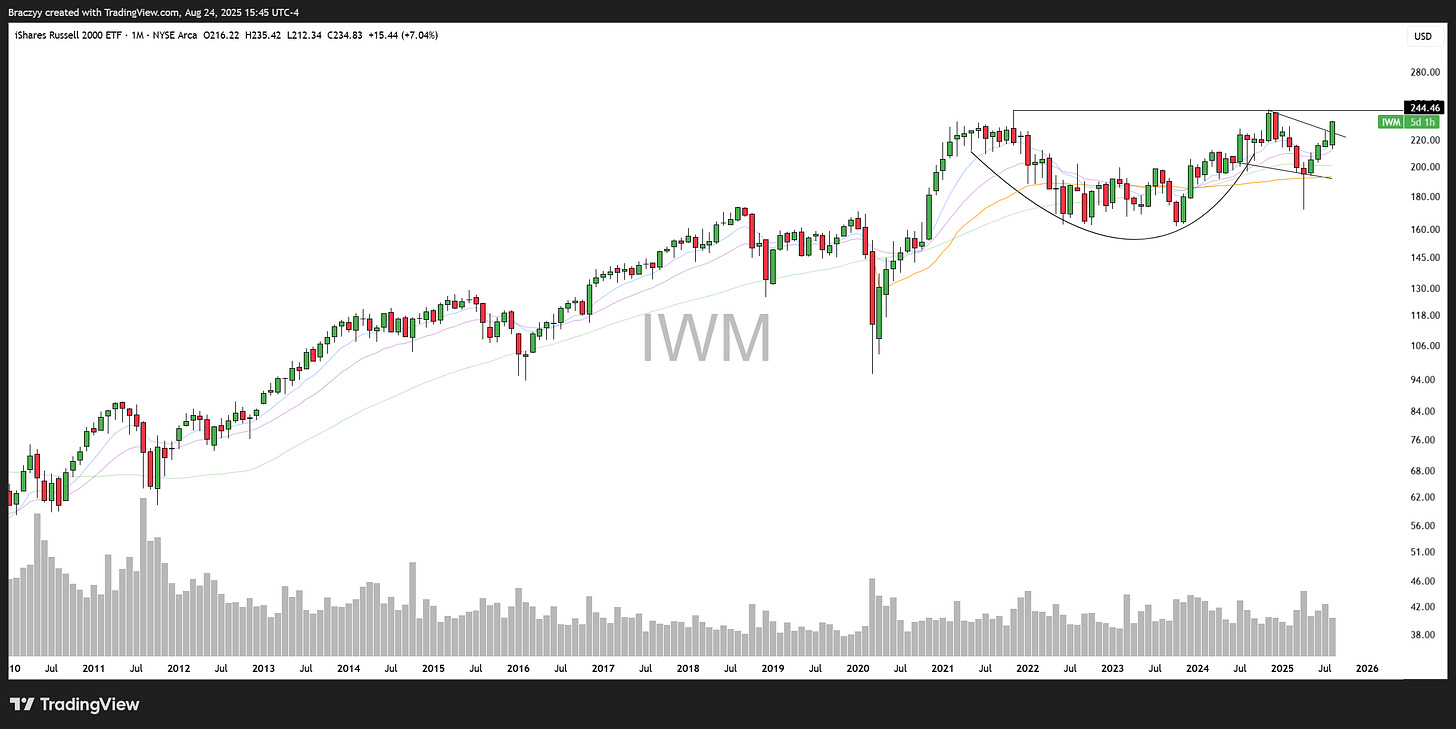

IWM (Daily)

A classic “SQUAT”. Following the two day move last week Tuesday and Wednesday the Russell2000 had six orderly days of pullback into the 20EMA. The squat is the best by the way. Failed breakout into an undercut of the breakout spot and tap into the moving averages then go. Such a great risk to reward and very reliable, especially lately.

SMH (Daily Chart)

Semiconductors got the 50SMA tap to hold and established $280 area as clear line in the sand support for now. Longer trend remains up, but expectation in range bound. NVDA earnings this week WILL have a massive impact on the sector. After that will have a clearer look at tech and semis.

XHB (Daily Chart)

Now the sixth straight week of posting the homebuilders ETF. Up nearly 50% on the leveraged ETF (NAIL). Thesis played out so far with XBI XHB TAN XHB with rate sensitive names seeing momentum and rotation. Now the stocks are in motion and the moving averages will guide. 20EMA management or Weekly 9EMA works as well if wanting to hold longer.

BTC (Daily Chart)

Early week weakness with the rest of the “tech”/risk on areas of the market. Wedge drop below MAs early on brought BTC right to the $112K spot. We have seem numerous failed breakouts and squats to support levels leading to continued strength after those support holds. Would love for this to hold $112K, build out tighter and the push to ATHs. If we get that $150K is in the cards. If we lose 112K we can reassess.

ETH (Daily Chart)

Continues to outperform in a big way with the Tom Lee bid. Still long in the group via ETHA ETHU and ETH. So far just a strong trend, a breakout retest, and building right around previous ATHs from 2021. Eventually this will need longer consolidation but the major tailwinds for ETH continue to allow this to lead the crypto space right now.

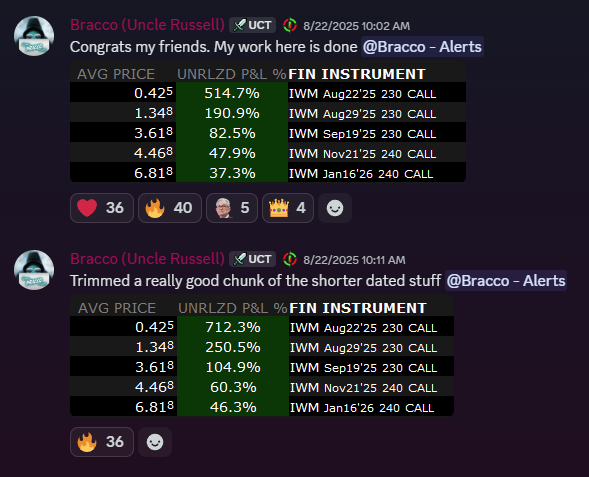

Bracco’s Breakdown & Top Ideas

For those that read Sunday Scans from last weekend, the only idea I discussed was long IWM (small caps). I gave a full breakdown on why I thought it was such a fat pitch, discussing the record level of short positioning, the QQQ/IWM ratio chart, the monthly cup with handle base, and the T2107 breadth indicator. The conviction just continued to build stronger and stronger throughout the week as IWM showed incredible relative strength versus the S&P and Nasdaq. It was trading like a beach ball underwater for multiple days straight. I believed IWM was trying to give us clues and front running a dovish Powell into Friday.

The idea pretty much played out to perfection with IWM exploding +4% to end the week as Powell signaled interest rate cuts could be on the horizon. I did add a good chunk of short dated exposure to capitalize on that short term volatility as I expected Jackson Hole to act as a huge catalyst for this idea. Most of the size on the shorter dated stuff was peeled off on Friday, but I remain very long September, November, and January calls.

Looking back at IWM’s price action throughout the years, you’ll notice that it does not trend very smoothly. It has a habit of making quick, explosive moves around macro catalysts and then follows up with vicious pullbacks, sometimes erasing the entire move. If we do get some sort of 3-5 day burst with no rest, I will likely be quick to trim off more size as it does not have a good record of holding up following these types of moves. Here are a few past examples of these moves below:

On the other hand, the larger timeframes also look more primed than ever. Most participants are aware that IWM usually disappoints and is only ever good for a quick trade before it goes back to underperforming, but what if this time is different? You could argue that it can really make a powerful move this cycle as it has built out a very big multi-year base. Two scenarios I will be keeping in mind while judging the price action this week.

Managing the rest of this IWM trade is all I am focused on right now. As that trade plays out I will shift my focus to finding the next big idea and try to capitalize on some smaller, easy money trades in the meantime. Pretty happy with my last two big trade ideas posted in this substack which were long ETH in July and now long IWM. I really do my best to only provide the best of the best opportunities. I am excited and curious to see how the market digests Friday’s action as the week goes on, should be plenty of opportunities either way.

TSDR’s Weekly Outlook & Watchlist

In the discord we offer live trading everyday, position updates, entry and exit alerts, watchlists, scanning, daily lessons, and active chat to ask questions about anything you need. Go to our website and use code “SUBSTACK” for 15% off forever.

Current Positions - ETHU ALAB CRDO BE TEM TSLA OPEN NBIS IWM SEDG WULF USAR CIFR

Update - Still holding winners in ETHU, ALAB, CRDO and BE. TEM now have over 25% cushion and I was able to increase my size. Basically just following Manrav on this trade because his read has been spot on with TEM. Holding OPEN in my Robinhood account, not my main trading but decided to list it on here. Got a nice size into that and up over 60% on shares. The hype and retail focus along with the chart is just something I could not pass on. TSLA & NBIS added heavy size on Friday at market open $324 & $65 respectively. IWM had to get involved and got some size with Bracco & Manrav ideas. Listen, when Bracco is talking about something the way he was IWM it is essentially a guarantee its going to play out. SEDG holding from $26.9 last Friday breakout and it is looking great. WULF holding 1/2 size at $6.91 from Google headline last Thursday. USAR put on a small options position for March 2026 thinking this is an OKLO type stock potential. Worth a few thousand risk imo. CIFR bought at $5.75 and up over 10%. Happy with my patience and getting involved in the stocks I am in. I have a good chunk of margin used with potential to add 1 maybe 1.5 more positions next week if I choose to go full margin.

My approach & Weekly outlook, Later in the week I emphasized how this is the first real multi day correction or pullback in stocks since the April lows. We have had 2-3 shakeouts but really this is 5-6 days red and clearly a shakeout to be ready to get involved in once we see some willingness to buy. I thought I was going to miss out a bit when Wednesday lower wick got bought aggressively but stuck with my plan to stay patient into Thursday and Friday and that paid off.

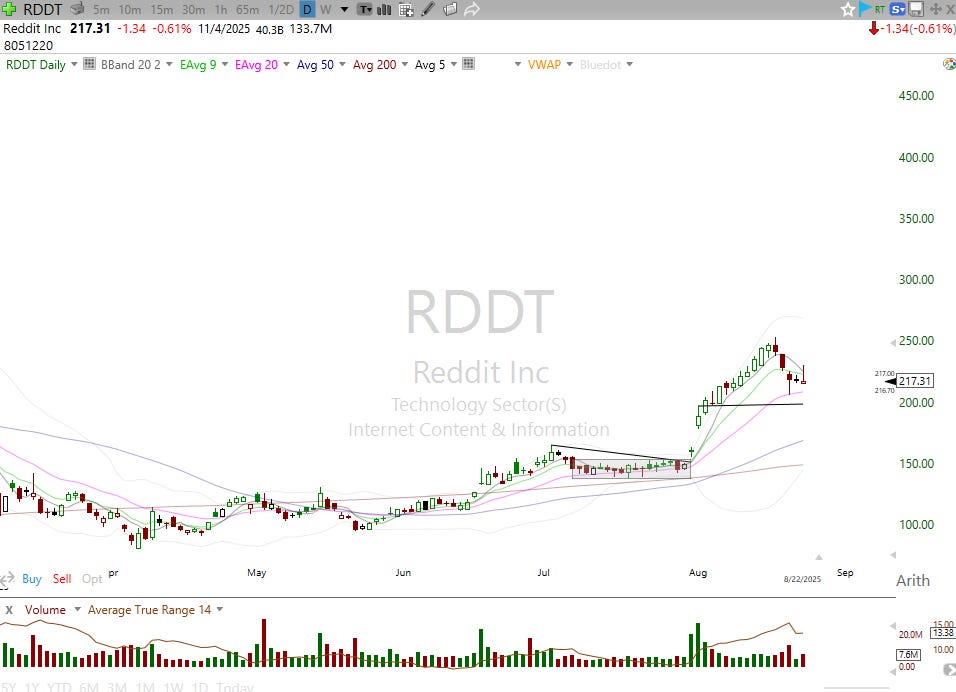

Looking forward to next week I plan to diligently watch my positions managing most against Friday’s low. Would like to see Monday and Tuesday strength continue but would be okay with an inside day on stocks as well. Mindful that “leaders” did not perform much this week and even on Friday. Stocks like GEV RDDT held back, which I am totally cool with. I think we have PLENTY of merchandise to choose from with the market looking the way it is and expanding participation.

Some great charts below that I am watching.

Charts Covered - Z U MGNI TSLA NBIS RBRK MSOS ANET ZETA LMND RDDT + Broader Watchlist

Z (Daily)

Watching this large base under $88. High volume candle after undercut of 20EMA. Want to see it get tight here for a bit. Play on ARKK and the rate sensitive plays.

U (Daily)

Highlighted during the week with the oops reversal off the 20EMA on Thursday and the relative strength that day. Has been a strong performer since $25 breakout and could easily see $50+. An inside day or red to green move to start the week would be actionable. Ideal spot was Thursday against the 20EMA.

MGNI (Daily)

Building a great pattern under $25 here. An inside day would allow for entry mid week.

TSLA (Daily)

Got my position on Friday at $324 but really like this launchpad here with all the moving averages stacked tight. Clear risk against Friday’s low or the 200SMA. Expecting this to get $370 shortly and that might find some true breakout buyers there. I think this is a phenomenal look and we know how TSLA trades. I think if we can see strong follow through that $400 quickly is not absurd.

NBIS (Daily)

Has been a main go to for me over the past year and have captured almost every move. Wednesday it undercut the ER gap up low and quickly got bought up then rest on Thursday followed by a bullish engulfing on Friday. Expect Friday’s low to hold and it to push $80 quickly. Feels like a no brainer trend to $100 level.

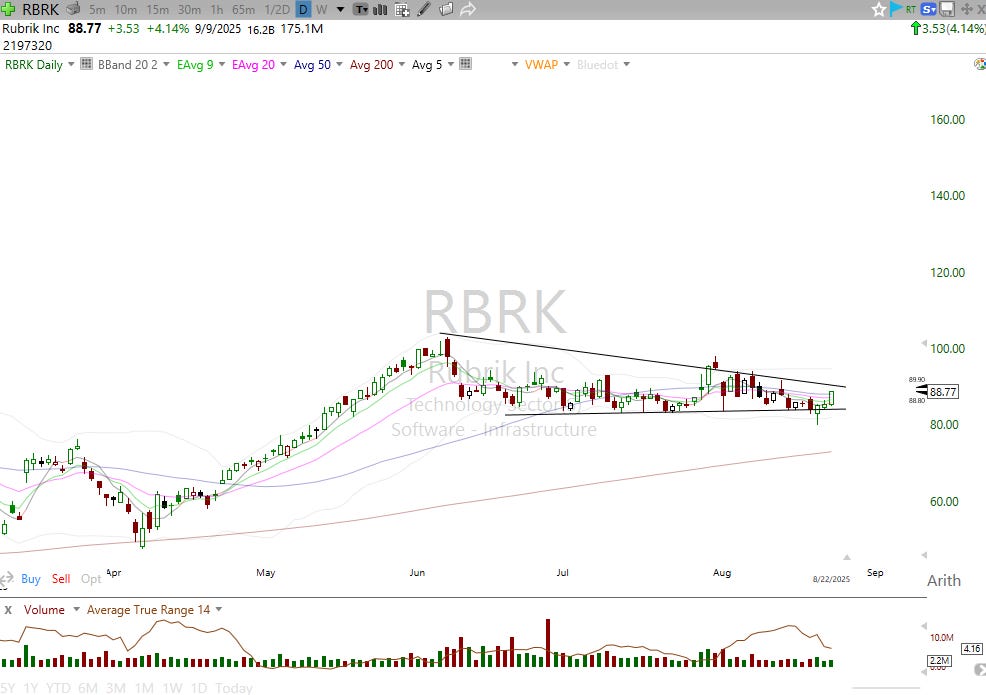

RBRK (Daily)

Have been watching closely for an undercut of $80. We got that but I did not like the declining moving averages. Waiting for this to push out and form a higher low to get involved. The growth and range of this stocks requires it to be on my watchlist. Weekly chart gave a clean upside reversal and retest of previous base high from 2024.

MSOS (Daily)

Cannabis headlines still coming in and this has been a strong mover nearly doubling in the past month. TLRY GRWG MSOX some individual names to play.

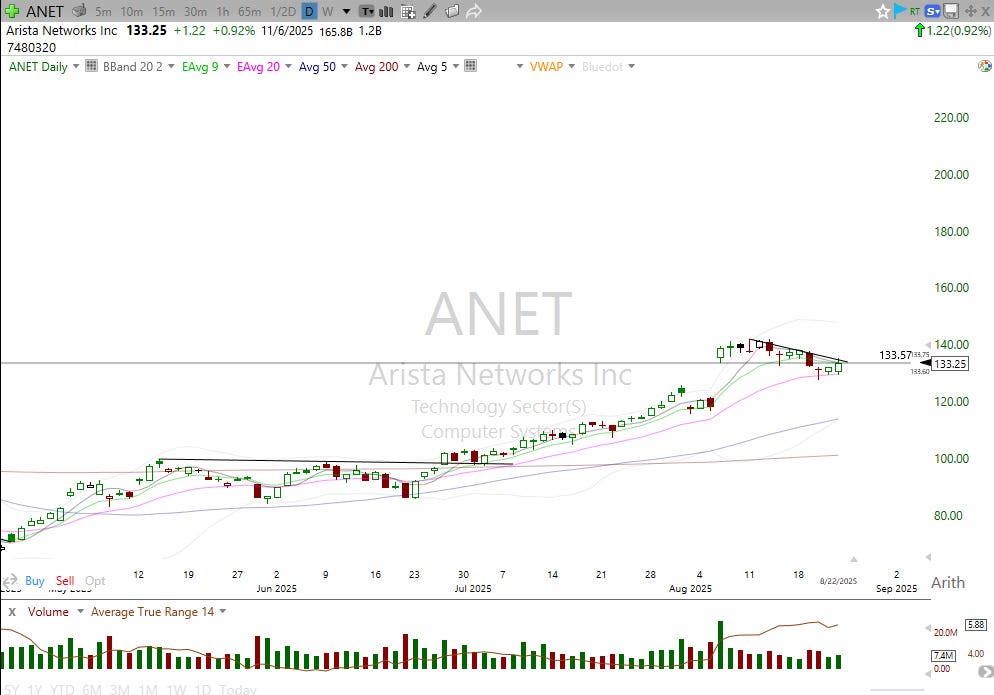

ANET (Daily)

Classic post earnings gap setup and building around previous ATH. Held the 20EMA last week and remounted. Inside day would be awesome to avoid wedging up behavior. Weekly may need some more consolidation to form classic handle pattern. Stays on radar closely.

ZETA (Daily)

Love the volume pattern here and if this can take out the HVC (high volume close) at $20.23 then I think this can really kick into gear. I will add that I would prefer that this 200SMA was sloping up. So I am mindful that this may take time for that to occur. Either way if I get my trigger I will take it.

LMND (Daily)

Stays as a priority and one of the best post earnings trades. Really disappointed that I am not heavy into this from day 1 earnings or the 3-4 days after. But I will get my spot on it. Would prefer further buildout and a 20EMA tap on the daily. $60 acting as resistance right now so we might get that soon.

RDDT (Daily)

Did not perform on Friday with the market but it has proven itself and deserves the benefit of the doubt. Watching for buildout near the 20EMA and for the weekly to form a handle. I will be getting back involved in this. A top AI name and phenomenal earnings and sales growth. If this gives us the setup we look for we have to take the shot.

Broader Watchlist - AAOI AEO AFRM ALAB AMD AMSC ANET APLD APP ARKK BABA BE BMNR BROS CCL CIFR CLF COIN CRDO CRNC DOCS ELF EOSE ETHA ETSY FSLR FUTU GLXY HNGE IBIT IREN IWM JOBY LASR LIF LMND LYFT META METC MGNI MP MSOS MU NAIL NBIS NET NIO NTRA OPEN OUST OSCR PGY PL POWL RBRK RDDT RKLB RKT RMBS ROKU SE SEDG SHOP SOFI SYM TEM TLN TMDX TSLA U UEC UMAC UNH USAR UUUU VSAT WGS XMTR XPEV Z ZETA

This is the list I scan throughout the day and choose my focus list from after hours or premarket news and 3-4 from this list that are IN PLAY that day for action.

Closing Comments and Mindset

With NVDA earnings next week it seems as though all eyes will shift from Jackson Hole onto the next big event. Obviously will be impactful to the market but I think the market and watchlist ideas can still perform even if NVDA reaction is less than ideal. It is very good to see a wide variety of sectors catching attention aside from just SMH and QQQ which has led this rally.

Very strong action to end the week and a CLOSE BELOW Friday’s low would be a major warning sign near term. So we have our line in the sand to trade against which makes things fairly black and white. Expectation for early week action would be either inside day behavior and digest or immediate follow through. I think Friday was incredibly actionable and important to get 1-2-3 positions on, which we did. If not look for red to green moves on Monday or inside days to take action.

Plenty of stocks, sectors, and setups to choose from and the market is coming off the first 50SMA test of this rally. On top of that we have DIA IWM RSP MDY breaking out of 10 month bases. I believe being optimistic, excited, and willing to engage aggressively is still warranted.

Best reading every Sunday focusing on the market!!

Best group ever! Thanks Uncle Russell