Closed out the month of June on a positive note and started the 2H of the year with some fireworks, Happy Fourth of July.

Want live commentary, alerts, access to Bracco & TSDR, and a strong community of of 400+ committed traders?

Join the Uncharted Territory Discord using promo code “SUBSTACK” for a good discount!

NOW LET’S GET TO WORK AND GET READY FOR THE WEEK AHEAD.

WHAT WE WILL COVER

-(NEW) AI Summary of SUNDAY SCANS

-Schedule for the week of economic data and earnings

-Market Breadth Data and Internals

-Index and ETF Analysis

-Bracco’s Breakdown and Top Ideas

-TSDR Weekly Outlook and Watchlist

-Closing Comments and Mindset

AI Summary of SUNDAY SCANS

Powered By Perplexity

Starts with acknowledging strong performance from members in the discord, celebrating recent trading performance. Quick coverage of upcoming earnings and schedule for the week showing a light week of scheduled catalysts. Market Breadth Data shows broader participation and performance but notes possible caution in positioning and extension. In Indexes and ETFs we take a Top-Down approach to look at the market. It shows we have strength above key moving averages, and the strategy is to ride the rising 20EMA while staying alert for a possible short-term shakeout. The charts highlight key levels on QQQ, ARKK, SMH, and BTC.

Bracco is back from vacation and highlights the benefits of time off from the screens. His passion and energy is reignited and ready to engage with market opportunities. Noting the strength in the market from scanning, but potential historical model that may indicate some volatility in the near future.

TSDR highlights 9 stocks to watch including ASML AMD FUTU RBRK ETHA ODD NOW ATAI COIN and promises to send TSDR TOP 20 to the discord members this evening. Goes on to list out current holding positions including cash in account.

Closing out the newsletter highlighting the market environment, what style of trading has been working, and maintaining a big picture approach to the market.

Tell us your thoughts on the AI Summary! Was it valuable or Unnecessary?

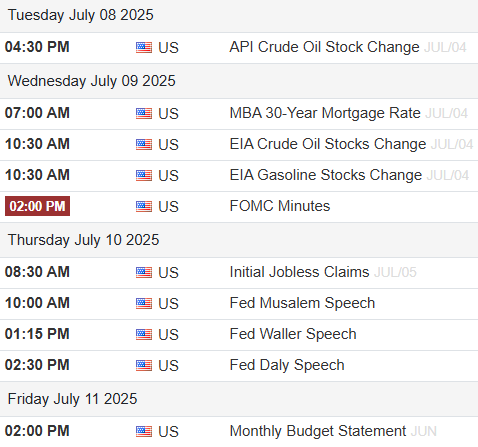

Earnings & Economic Calendar for the Week

Market Breadth Data

StockBee (Pradeep Bonde) Market Monitor

Bracco’s Market Health Tracker

T2108 (% Stocks Above 40MA) = 69.28%

T2107 (% Stocks Above 200MA) = 45.10%

NASI

Index & ETF action, hourly levels, and insights for the week ahead

QQQ (Daily Chart)

We are now 9 trading days off the 20EMA test, a key spot where an aggressive approach has been very valuable. Closed again at weekly highs up 1.48% during the short holiday trading week. Price is about 7.3% above the 50SMA and 3.3% above the 20EMA. I wouldn’t be surprised to see the market attempt to shakeout a bit in the coming days and welcome that. Approach is still simply that we are riding a rising 20EMA and continue to respect it. The reactions off the 20EMA have been nothing short of fantastic. Until that changes, I think we can rely on individual stocks, leaders, themes, quality of watchlist, and recent trade traction & follow through.

QQQ (Hourly)

Made a few minor adjustments to near term notable hourly levels. I mark out important higher low pivots, open gaps, lower wick bases, and flat top resistance areas. I rely on these heavily and have a great track record of accuracy seeing key pivots at expected spots. I’d like to see $543-$545 hold on a pullback and if that is lost I expect the $536.50 bullish open gap to maintain as support. If we see early week strength of significance into $565 or higher I think the market would be susceptible to a snap back, and a decent one. Lastly, I want to emphasize, that the worst thing I can say about the QQQ is that it is maybe “too strong”. Let the 20EMA on the daily guide us.

ARKK (Daily Chart)

I continue to watch for this to build a handle (Cup & Handle). Mostly a week of consolidation going sideways most of the short week. Ending the week up 1.70% with another tap of the daily 9EMA held. Cannot fight the trend nor deny it’s power, but any orderly pullback is welcomed and would be completely normal. In a perfect world ARKK would go sideways above the February highs for 3-4 consecutive weeks before making another leg up to $78 and $90.

SMH (Daily)

The bellwether Semiconductor ETF quietly made new all time highs on Thursday. This continues to be an area of the market to watch as a gauge for health and trend. We have a number of leading stocks in the Semi group (NVDA AVGO TSM KLAC) as well as dozens of large size emerging setups (AMD ARM ASML AMAT MU LRCX). One thing I want to point out that is often missed but a key sign of strength. Compare the recent action to the QQQ, while the Q’s flagged out to the 20EMA on June 23rd, the SMH stayed strong in comparison only touching the 9ema before pushing and making new highs. You can use these subtle clues to spot leadership and institutionally supported industries in the market.

XLF (Daily)

Financials, another sector of the S&P that made new all time highs. This broadened out from JPM, GS, WFC, MS into the regional banks (KRE) over the past week or so. Banks are not something I trade particularly often but wanted to note this while we saw the heavy financially weighted IWM (+3.53%) outperform all indexes this past week.

BTC (Daily Chart)

Looks about as coiled as it gets prior to a move. Notably showed relative weakness on Thursday before the Holiday weekend, now we will see if it has enough juice to break out of this pattern or if it is indicative of some rest in the market. Last major signal was the UnR (Undercut and Rally) below 100K. Last week attemtped to make a higher low at $105K. Over $110K would confirm a breakout of this 6 week consolidation.

Bracco’s Breakdown & Top Ideas

I am officially back from my two week vacation and can’t wait to get back to work. I am a big advocate of a 1-2 week break from the market each year. Almost a sort of “cleanse” or “reset” for the mind and body. I used to be of the mindset that “the grind doesn’t stop” which lead me into some bad periods. No breaks, no rest, no hobbies, just work. This was fun for a while until I experienced my first true burnout phase. I had almost nothing left in the tank. Each trading day blurred into the next, I lost motivation, and just consistently went through the motions. After I finally committed to taking a break, I realized how much precious time was lost in those 1-2 months of burnout trading. I consider full time traders “mental athletes” in a way. It is one of the only professions where if you’re not at the absolute top of your game, you will lose money. Who can be at the top of their game all the time? There is no room for mediocrity and that is not easy on the mind. For me, burnout phase = mediocre trading. Instead of relentlessly pushing myself over and over again, all I needed was a 1-2 week break to reset my mind and ignite the love and passion for the game again. You would be surprised how quickly you miss it after only a week away from the screens. It lights that fire again for me that can slowly die out over time as a result of constant, hard work. I have had some of my greatest trading periods following a break from the markets and I believe that is no coincidence. I think a big part of ones trading success comes from excitement, drive, and passion which can get lost after long periods of all work and no time off. That is why breaks have become non-negotiables for me.

As far as the markets and my trading goes, I always like to take about a week to transition back into the markets and my daily routine. It is easy to get trigger happy and aggressive right out of the gate following a break, my goal is to control that impulse. For me to have a really hot trading period I need to be completely in sync with the market. That feel and connection gets lost during a break and requires some time to build back up, whether it be a few weeks or just a few days. The easiest way for me to get back in sync is by making contact. For me making contact means small size base hits. Whether it be a intraday momentum scalp, morning PR, news gapper, etc. The goal is to just get a few good trades under the belt and a feel for what is working. With that being said, a majority of my time this week will be spent scanning, studying, and taking notes.

I do not want to give any strong opinions today as I have been out of tune with the market for the last 2 weeks, but here are a few thoughts I have coming into this week after reviewing some action that I missed.

The first thing I notice when scanning through my watchlists/scans is an extremely strong market with many stocks becoming extended from their last base or ideal entry points. From my perspective, the best place to really get aggressive and put on big swing positions in top names was late April to early June. It seems that the last week or two unlocked a burst of momentum in all the names that haven’t participated much since the lows. Groups like Solar, crypto miners, regional banks, etc. This is a great sign for the market as breadth and participation is expanding.

A few short term signs I am being mindful of:

1. We saw a significant shift in the AAII sentiment survey and NAAIM exposure index last week. The AII bull/bear spread jumped to 11.9% with the average exposure to US Equity markets reaching 99.3%.

2. T2108 is not a great indicator for timing tops, but can help guide short term aggression in the market. It closed last week at 69.28% and appears to want to push higher. Any pop over that 70% mark to the upside has not lasted very long over the last year.

3. We’ve seen a bit of a trend from the 2022 lows when it comes to the market breaking out to new highs following a notable correction or consolidation. If we take a look at the last 3 times the Nasdaq made new highs, a pullback and shakeout below the previous high has followed. With some short term extension on indexes/stocks and increasing optimism among participants after we’ve already made new highs, I would not be surprised to see this play out again. Here are a few examples from December 2023, May 2024, and November 2024.

With all that being said, I think I will be taking a slow and cautious approach for the time being. I have no exposure at the moment and am not trying to fomo into an extended move. Like I mentioned earlier, my top focus is getting back in sync with the market and my daily routine. Ideally will have more more value to provide next Sunday after a full week back engaged at the desk.

Join the Uncharted Territory Discord using promo code “SUBSTACK” for a good discount!

TSDR’s Weekly Outlook & Watchlist

Down below I listed some stocks that I think are ready to take action on as soon as this week. I do think we COULD see some rest soon but often can see the strongest and fastest advance prior to a longer consolidation period. I cover some ideas, my current positions, and a broader watchlist below. I expect the strength to continue into the early part of the week and then will reassess come Tuesday or Wednesday depending on the action. I have more cash than I would prefer in my account and will be looking to try some setups if they trigger. Spots like this in the market, mid move with immense strength just emphasize how important it is to DEFINE BUY DAYS in your strategy. For me, its holds of the 20EMA such as 6/23. That was the spot to be aggressive and in the first 2-3 days off that spot. Can we continue that? Yes I believe so, but know that it is less optimal but still opportune.

I will send out the TSDR TOP 20 in the discord, a mix of charts covered and the broader list that I think are actionable.

Charts Covered - ASML AMD FUTU RBRK ETHA ODD NOW ATAI COIN

ASML (Daily)

GO SIGNAL on Wednesday followed by inside day Thursday. Holding the top of this nearly 9 month base. As stated last week, anything under $786 I expect to support and offer good risk to reward opportunities.

AMD (Daily)

Could be ready as soon as this week, ideally it give a bit more sideways. Double inside days. Would like to see it dip to $133.30-$130 and hold the bullish open gap from that spot. Volume pattern since 200SMA break makes this a must watch on pullbacks imo.

FUTU (Daily)

Flagging out under the 3rd tap of this flat top resistance. Volume is drying up and any market wide catalyst for China stocks could see this lead the way. Near term support under $120, next spots are $117.5 and $113.5. $127-$130 needs to break for momentum.

RBRK (Daily)

First pull since its lock out move after 4/7. $90 and $94 levels above to take out. Will watch on hourly timeframe for a higher low to enter.

ETHA (Daily)

With ETH treasuries gaining major attention and ETH having shaken out recently I think this is reasonable for a close watch. Will be looking for thrust above $20. Think ETH could see some serious catchup action. Focus remains IBIT & COIN, but good one to add as well.

ODD (Daily)

Tight flag following explosive earnings move. Holding over $76 can push into new highs and $90 range.

NOW (Daily)

Best in class software stock that held the 200day following a 7 week consolidation, squat, then breakout. Anything sideways, preferably an inside day, and this is a top watch. $1030-$1045 want to see hold as support before further strength.

ATAI (Daily)

HVE (Highest Volume Ever) following news last week. Want to see it tighten up here and build over this 2 yr base.

COIN (Daily)

The price action in Coinbase resembles that of a continued major opportunity and liquid leader. The range this stock has is unlike many others. This has been an A+ opportunity since its breakout on 6/18 and the first pullback is behaving properly. Maybe the 9EMA pull is all it offers before pushing further. Maybe it needs to base a bit more. I think the stock deserves attempts to try to get it right if not already in. And for those that are, I think looking to add back partials trimmed into strength is very reasonable. IBIT has potential to break it’s consolidation, however it lagged the Nasdaq decently last week. Not sure yet if that is indicative of anything or just waiting to push higher. $350-$360 seems to have been accepted on COIN, Buyers stepped in below to bring it back to equilibrium in that zone. I think getting involved with reasonable and defined risk via IBIT BITX COIN is the way to go.

Current Positions- NBIS TSSI COIN CRDO LMND IREN STNE KWEB HOOD (40% cash which I think is too much, explain down below)

Actually lightened up a decent bit throughout the week and took out a nice withdrawal. Sold off two lots of 1/10 size of HOOD position, trimmed partial NVDA position from 4/7. Trimmed NBIS trade by 1/4. Trimmed IREN by 1/4 at $18.10 from $10.42. Trimmed LMND by 1/3 now from $34. Sold INOD for profit, sold SERV flat, sold BBAI at $7.50 from $4. Tried a few trades early in the week and made a few lost a few. Left early on Wednesday to drive up north for the holiday with my Family. Wish I had stuck around because there was some buyable action and I have too much cash in my trading account now. Had I been around those two days I would’ve added 1-2 full positions.

Traded AAPL from $200.30 to $209 and wish I held, was my intention to flip that and move the money into a new trade but decided to end my week early and didn’t find a spot for that money!

Broader Watchlist- AAOI INOD CRNC HNGE WULF CIFR RBRK DOCS OSS JOBY NOW FTNT QS APPS COHR RGTI LIF RCL ALAB QTWO TOST ENVX ONON MNTN QUBT SAIL RL ZETA SNOW NVTS BA UBER AMZN OPFI AIP SHOP PAAS DELL ZM FUTU NAIL RUM SERV GRRR UUUU SOUN APLD KWEB IONQ TSSI BLDR OPRA LEU INSM AMTM SMCI IBIT PCT ASTS TSLA RKLB URBN LRCX UEC POET SE DE LLY BILI ARM COIN MSTR MU GOOGL NBIS UPST ULTA GH VG ATAI SLV NU CPNG INTU MBLY CRSP CCL STNE ODD LMND AFRM IREN ASML AMD ETHA RBRK

Closing Comments and Mindset

Market is strong. The leaders continue to lead in a big way, shallow pullbacks are getting bought up, and rotation is alive and well benefiting more and more stocks. We are 60 trading days off the bottom and 9 sessions off the 20ema straight vertical. I expect the market to continue but could very easily see some slowdown, that would be just fine. All in all, there is plenty to choose from in terms of setups. Leading and established names with brief pullbacks, newly emerging small/mid caps coming out of bases, thematic movers running on group speculation, catalyst and news driven momentum bursts, this market really has it all.

It is important to note that classic pivot level breakouts have seemed narrower in terms of immediate success, but buying holds of rising moving averages has been very reliable. I see no need to get fancy or make bold calls. I want to continue to seek opportunity and find good risk to reward setups with high chances of momentum and follow through. I prefer to maintain an active and aggressive approach until the evidence is present. Trim into strength and trail winners, keep stops on initial positions tight, look for above average setups in good groups and see what sticks around in the account.

I think maintaining a bigger picture outlook remains incredibly important to avoid fear and hesitation. Welcome a potential pullback and rest as an opportunity to get involved at reasonable spots. We are witnessing history, let’s carve our own path and SHRED.

Feel free to comment any ideas or suggestions that you may have to make the newsletter better for everyone!

Thanks! Like the new summary!

Great write up team, pumped for a great week. Glad Bracco's back and refreshed. We all know what happened last year when he came back (no pressure)