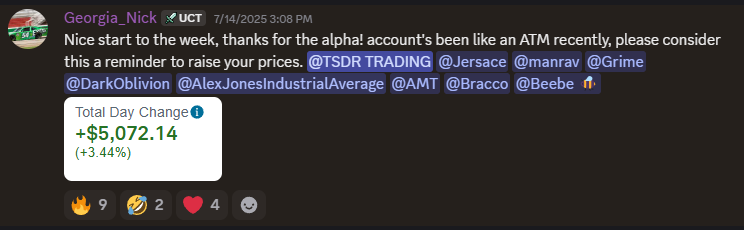

Good Afternoon Folks! There is no denying how phenomenal this market has been since late April and especially recently. The trade opportunities have been actionable and exciting nearly every day recently, it is critical to take advantage of it while you’re hot. We continue to highlight, alert, and identify the best leading names on the charts. Let’s take some time to highlight and enjoy the successes.

WHAT WE WILL COVER

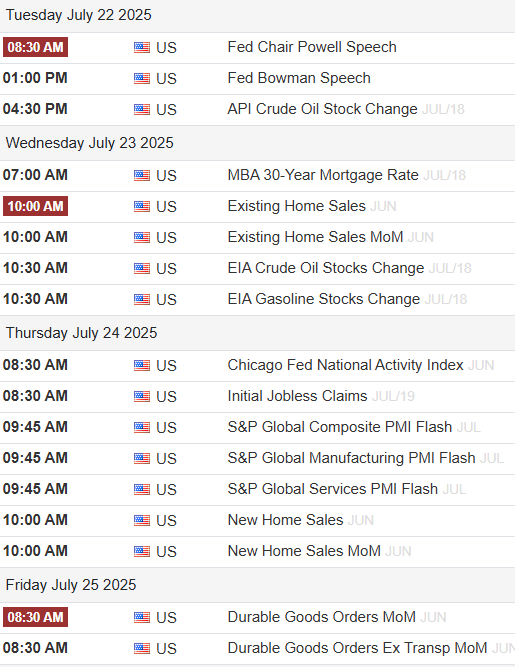

-Schedule for the week of economic data and earnings

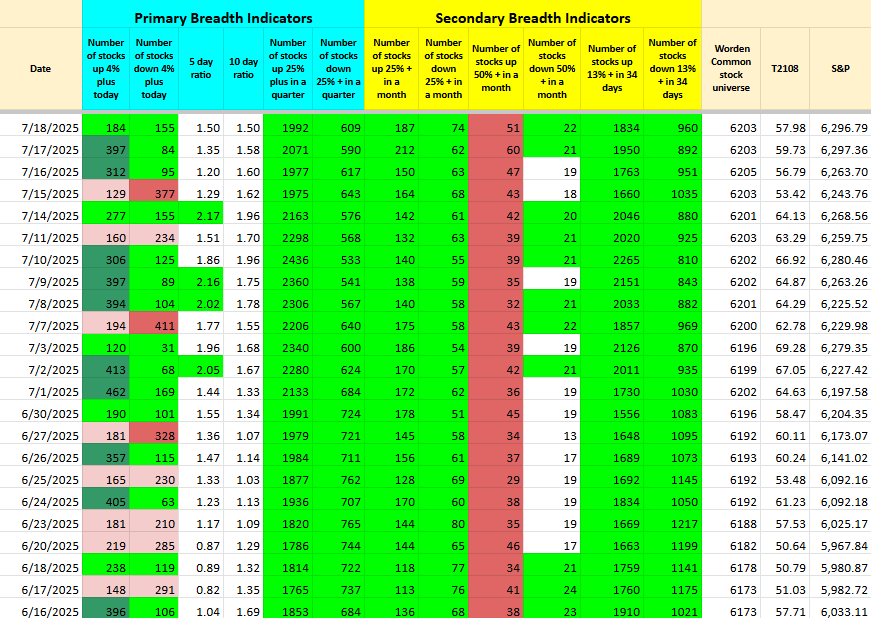

-Market Breadth Data and Internals

-Market Themes/Strong Groups

-Index and ETF Analysis

-Bracco’s Breakdown and Top Ideas

-TSDR Weekly Outlook and Watchlist

-Closing Comments and Mindset

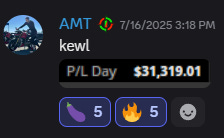

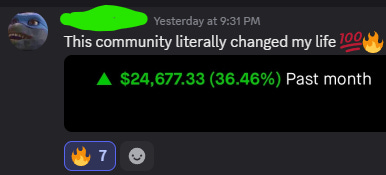

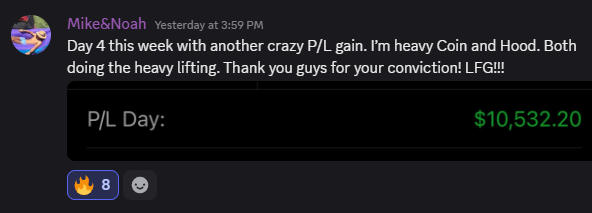

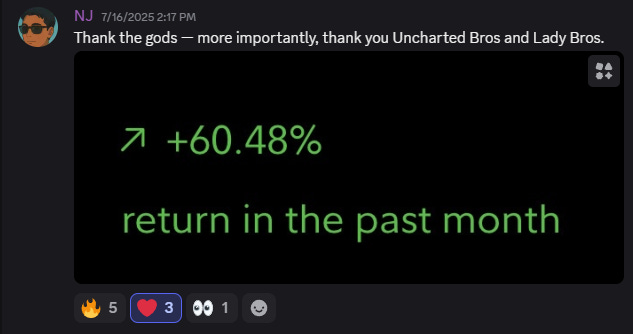

Want live commentary, alerts, access to Bracco & TSDR, and a strong community of of 400+ committed traders?

Click here to Join the Uncharted Territory Discord using the promo code “SUBSTACK” for a 15% discount on ALL payments!

Earnings & Economic Calendar for the Week

Market Breadth Data

StockBee (Pradeep Bonde) Market Monitor

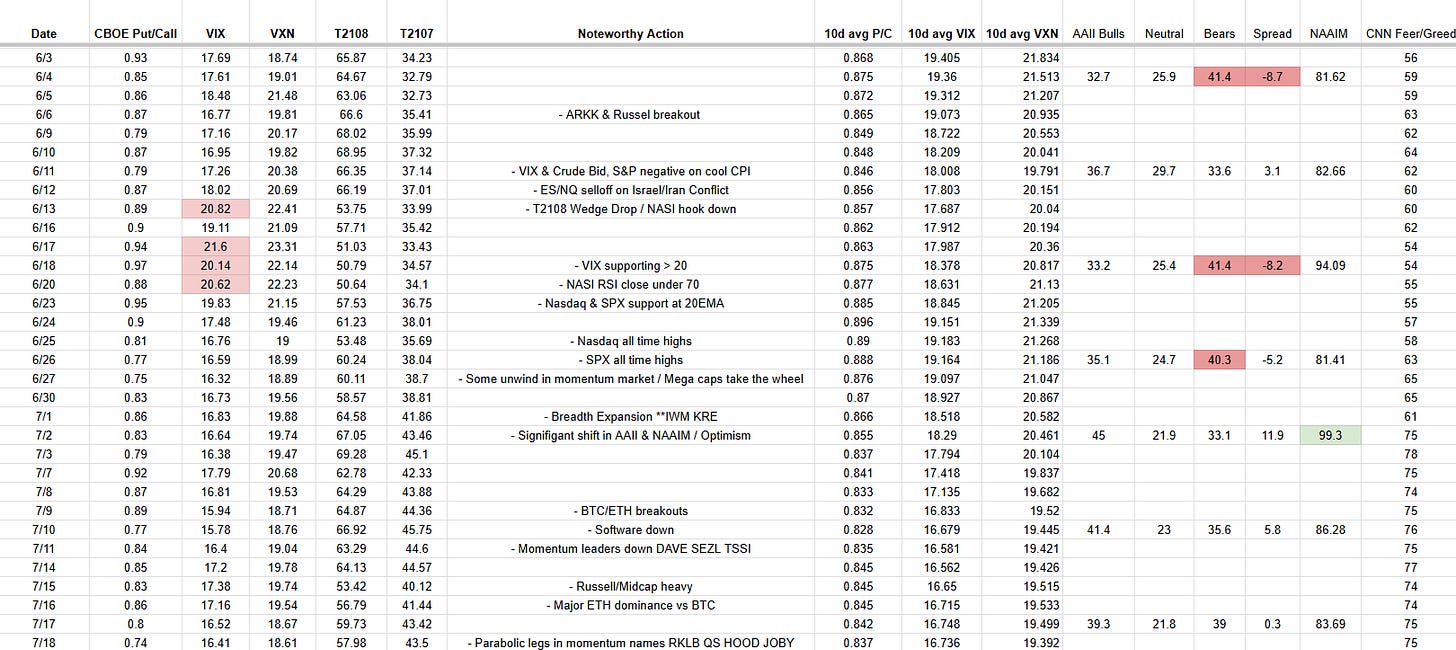

Bracco’s Market Health Tracker

T2108 (% Stocks Above 40MA) = 57.98%

T2107 (% Stocks Above 200MA) = 43.50%

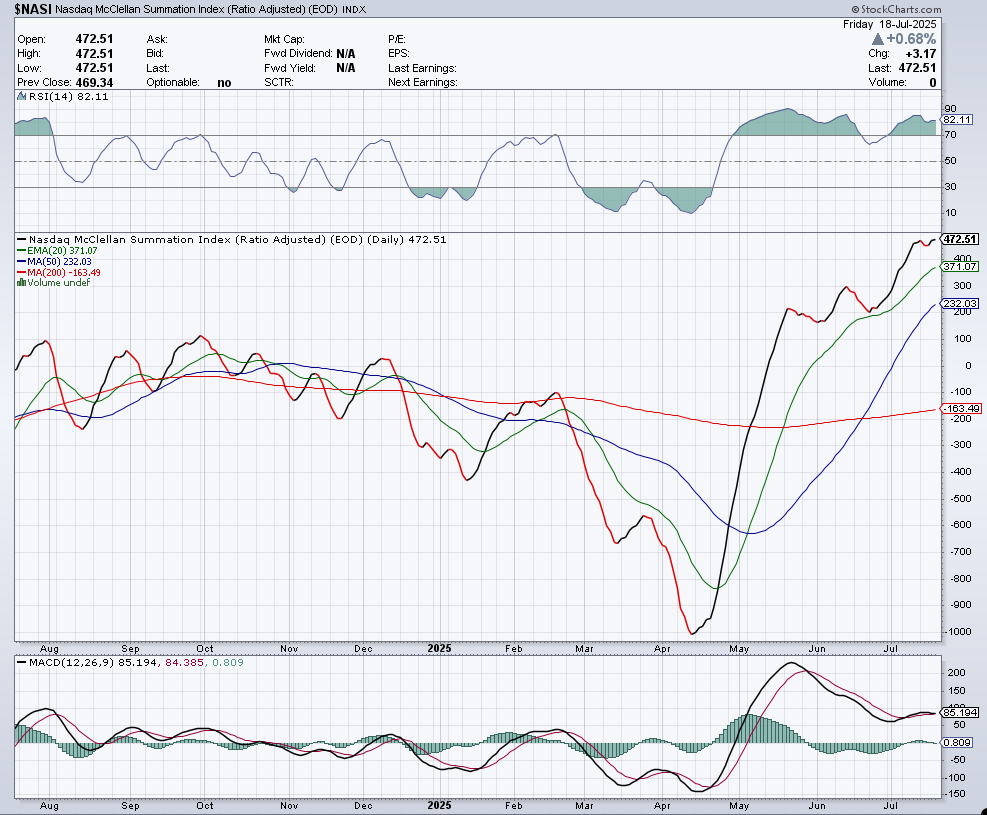

NASI

Market Themes, Leaders, & Groups

Crypto/Treasury - COIN HOOD ETHA IBIT GLXY CRCL IREN CIFR RIOT HUT BTBT SBET XXRP BTOG TRON BMNR HYPD ABVE SMLR

Semis - NVDA AMD AVGO TSM ARM ALAB NVTS KLAC MU STX LASR

Nuclear - LEU SMR OKLO CCJ LTBR

Quantum - RGTI QBTS IONQ QUBT ARQQ

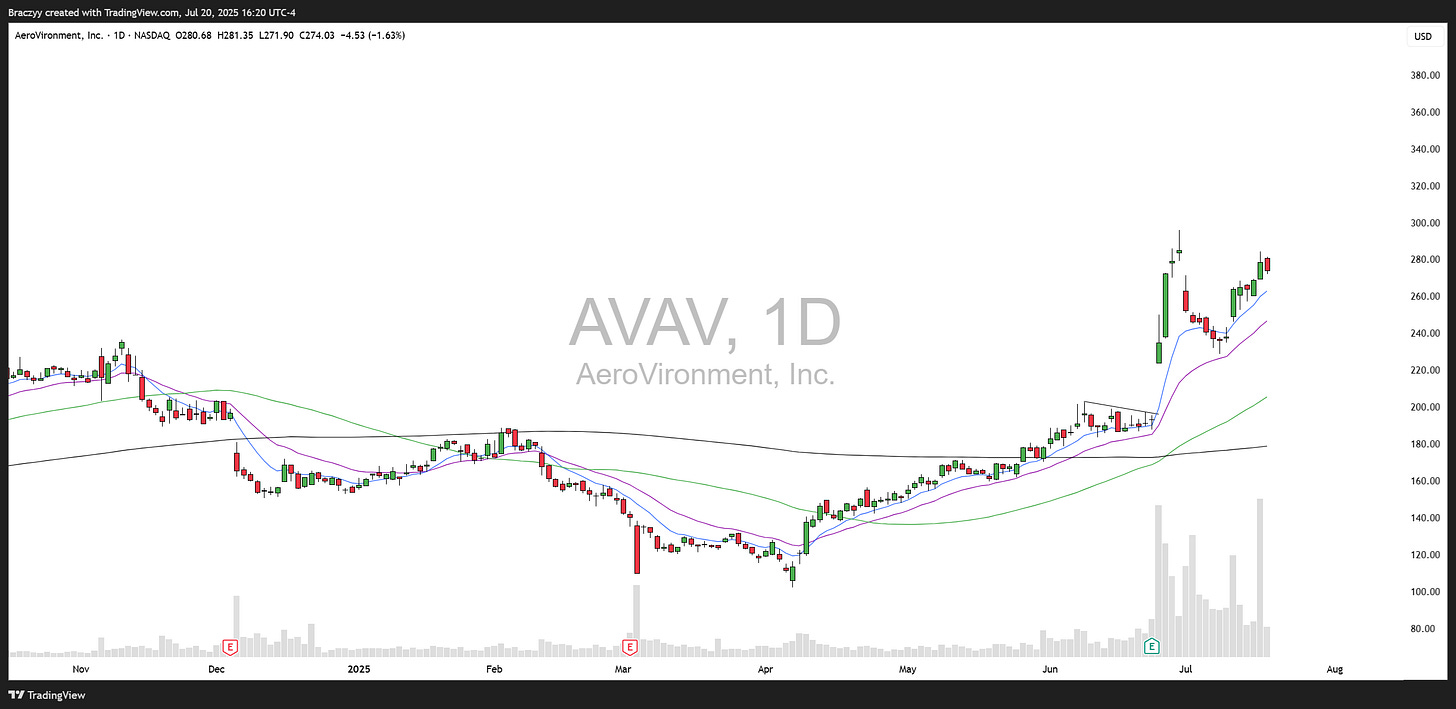

Aerospace/Defense/Drones - RKLB ASTS RDW PL KTOS AVAV BA KRMN JOBY ACHR AIRO BKSY RCAT UMAC ZENA ONDS

Robotics - SYM SERV PDYN

Auto/Lidar/Batteries - OUST AEVA INVZ QS AMPX ENVX EOSE ABAT PCT CAR CVNA AAP LCID

Solar - NXT SEDG FSLR TAN

China - FUTU BABA TIGR KWEB VNET GDS TME

Datacenter/AI/Software - TSSI NBIS PLTR CRDO APLD BBAI CLS SOUN AAOI OSS U ORCL TWLO DOMO LITE APH JBL DELL SNOW IBM

Minerals - MP USAR UUUU ASPI METC TMC CRML UAMY SLI

Fintech - HOOD COIN TOST SOFI UPST AFRM SEZL DAVE LMND PGY

Cyber Security - CRWD RBRK ZS NET DDOG SAIL

Power Generation - TLN CEG VST GEV AMSC NRG POWL

Travel/Leisure/Apparel - RCL CCL VIK UBER UAL DAL BKNG AS URBN ELF FIVE TPR RL

Internet/Social/Consumer - RDDT RBLX DASH SHOP SE CART AMZN META RUM ROKU LIF PRCH MNTN HNGE

If interested in a theme or group, look for the BEST & STRONGEST from this list. There are some that are not necessarily leaders but when a thematic or group sees action the whole list will participate in some way. This is intended to be a broader thematic list, your job is to pick the best stocks in the strongest groups!

Index & ETF action, hourly levels, and insights for the week ahead

QQQ (Daily Chart)

Up 1.27% for the week and closed green every day except Friday which was down a measly 0.10% for the day, essentially flat. New all time highs again on Friday before pulling back to $560. Index continue to grind and chop while stocks outperform. Extension from the moving averages have lessened as the range has narrowed. Nothing in the indexes to signal caution. Above all rising moving averages, until that changes let’s rely on stocks! More money has been lost anticipating a pullback that has ever been lost during one.

QQQ (Hourly)

Added the $560 and $563 levels this week to my chart. The $551-$553 zone continues to provide significant support and has for over 2 weeks now. Still trading level to level positively. Some more gap ups getting faded that prior in the run but just leading to long hourly lower wicks on the candles at the first and nearest support levels.

ARKK (Daily Chart)

Finished the week up 7.39% and continues to trend up the 9ema. Towards the end of the week started to see signs of parabolic action into the $78 resistance level we have mentioned for the past 7 weeks as the area to push towards. Top performers being RBLX CRSP SHOP HOOD PLTR COIN. Watching how we react up here a lot closer than we have in previous weeks. Rest would be expected and welcomed. But it would be just that, rest.

IWM (Daily Chart)

Building out a nice range here that I anticipate will hold above the 200SMA and eventually result in an upside move. Trade idea mentioned in last week’s post against 217-218 played out and 225 still acting as resistance. A few more tries in this base and could be actionable.

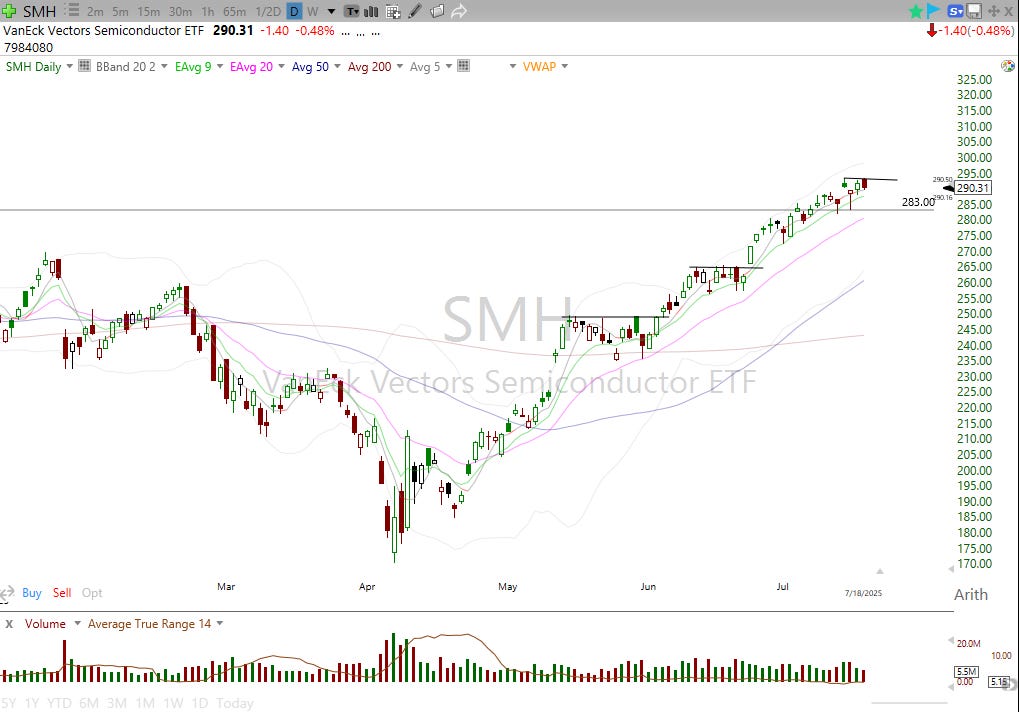

SMH (Daily Chart)

Semi conductors are the leading group in the market. Pay attention to them. Have retested the previous ATHs from July 2024 and I believe that will continue to hold on any further back tests.

BTC (Daily Chart)

Consolidation week for the most part while various other cryptos showed strength. BTC dominance fell mostly due to ETH outperformance. Would be a very positive sign for Bitcoin if a sustained push above $120K occurs. If that happens, oh boy.

ETH (Daily Chart)

This is just a thing of beauty. Seeing ETH sustain a move like this with the power behind it is phenomenal. Excited to see when, where, and how this consolidates after this massive move.

Bracco’s Breakdown & Top Ideas

Last week was pretty incredible with so many stocks and themes catching fire. I only took two trades myself—both small losses—but most of my focus was on managing my concentrated positions in ETHU and ETHA (the Ethereum ETFs). We talked about this setup in the last newsletter, and the thesis behind it is still playing out. Ethereum has now put together eight green days in a row and is up nearly 30% since last Sunday.

We did notice a few leaders break down two weeks ago—names like TSSI, SEZL, and DAVE. These were among the first stocks to emerge and a some of the best performing names from the April lows. Last week we saw numerous momentum leaders begin parabolic legs higher such as HOOD, COIN, QS, JOBY and RKLB. If some of these start to blow off and fail at the highs, it could be a warning sign for the broader market. Then again, every time a group breaks down or loses steam, a new theme emerges. This has been one of the strongest momentum stretches we've seen since 2020 and my best advice is to take advantage of it while it’s here.

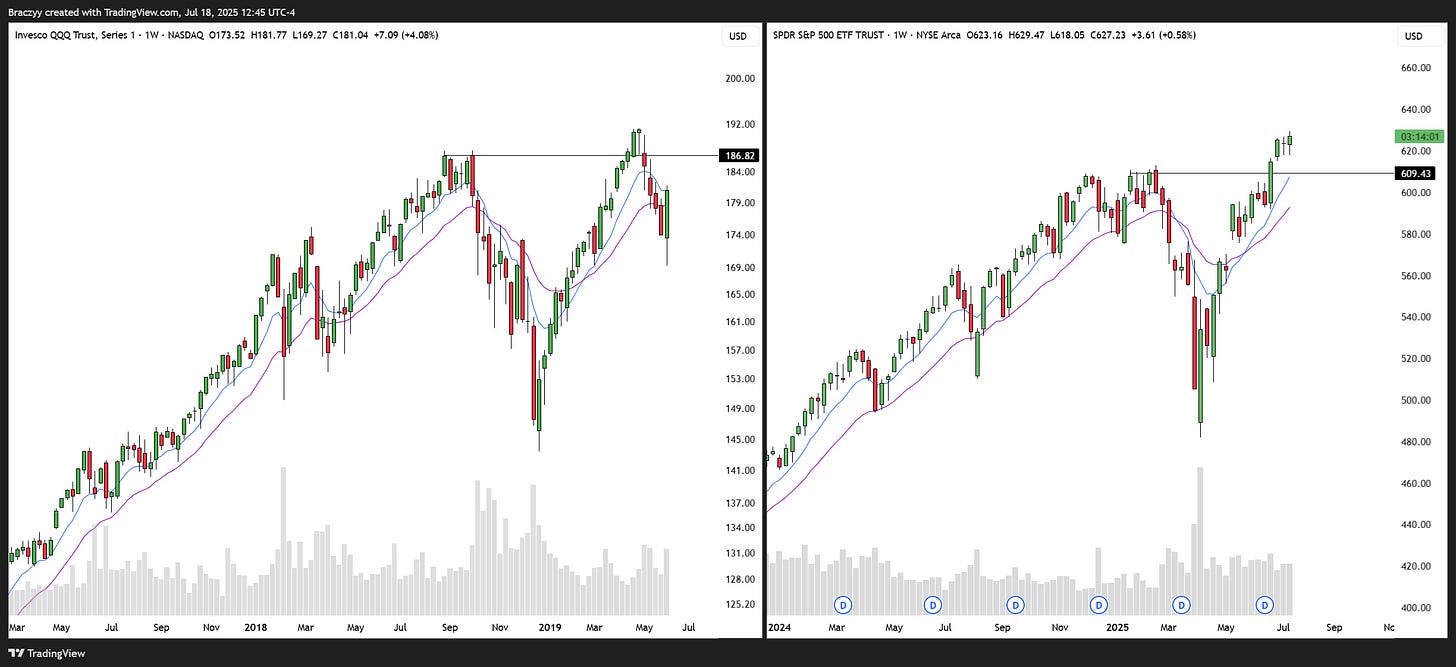

That said, we’ve seen a pattern the last couple of years where the market gets really hot in July and then pulls back into Q3 earnings. In 2023, we saw a -12% multi-month correction from the July highs. In 2024, the Nasdaq and semis made a parabolic move in July and then fell -15% into early August. Could we get a similar move this year as the market feels quite euphoric in mid July with earnings approaching? It wouldn’t be a surprise given how big of a move we’ve seen and how extended many names have gotten from their moving averages. See both corrections below.

As we discussed two weeks ago on Sunday Scans, it’s completely normal and quite common for indexes to come back down and retest or even slightly undercut previous highs following a correction and recovery to new highs. If things do pull back deeper than expected, the 2019 recovery could be a good analog to track. See chart below comparing 2018–2019 vs today’s setup on the weekly timeframe. On the other hand, if this is like 1998 or 2020, we may just keep grinding higher as we have been. Always good to prepare for multiple scenarios.

I’m currently holding Ethereum as my only position, with no major new ideas at the moment. While a handful of names are on my radar as potential setups for parabolic shorts, they are not quite ready yet. The market environment remains exceptionally strong: momentum is driving nearly everything higher and every dip gets aggressively bought. I am not trying to ruin the party, but during a period like this it’s very easy to get caught up in the euphoria and lose sight of risk management. You can continue to be aggressive and take advantage of a hot market while also remaining systematic and objective. Eventually, this market will experience a deeper, more prolonged pullback than anything we’ve seen since the April lows. When that happens, those who fail to adapt and shift their approach will likely see a significant drawdown, potentially giving back much or all of their gains from this run. Don’t let complacency creep in; have a plan for when price and sentiment finally shifts. Stay focused and be ready to adjust your approach as conditions evolve, because strong tapes like this don’t last forever. Discipline is what will protect you from large drawdowns, and large drawdowns are the enemy of compounding.

TSDR’s Weekly Outlook & Watchlist

Current Positions - COIN ETHU SLV IREN CRDO NBIS TSSI LMND USAR ALAB RGTI

Update, ETHU COIN and NBIS being the highlights for the week on current positions all putting in very strong weekly candles.

-ETHU was up 37% on the week, COIN was up 8.5% on the week, NBIS was up 19% on the week. ($59.85 avg)

-CRDO remaining position saw some rest and pulling to 20EMA. ($70.70 avg)

-IREN was up 10% this week, awesome. ($10.42 avg)

-SLV went sideways for the week. (Oct & Dec Calls)

-I stopped out of ASML STNE and KWEB this week (KWEB stop was STUPID, I had a bad options contract that wouldn’t have allowed me to profit off the move)

-TSSI, LMND, NBIS rewarded me for patience and trailing remainder of the position against the weekly 9EMA. I actually think I should have added to my TSSI position this week, I know some in the group did and we discussed it. (TSSI $13.43 avg, LMND $34.00 avg, NBIS $38.44 new avg)

-USAR was a new add from last week’s Sunday Scans list off the MP news. I love this action and look and have a 33% cushion on shares already, however, I should be in the leader MP instead. (USAR $11.11 avg)

-RGTI I bought at $13.16 off the News it had on Wednesday. ($13.16 avg)

-ALAB, I followed my dear friend and colleague into at 91 and 93. ($92.44 avg)

I have stops in place that I mentioned in the discord and plan to trail against the moving averages for as long as I can on these! No updates in Long Term positions this week.

My approach, I am on margin and have room for 2 new positions in my account, potentially. I trimmed a small portion of ETHU & COIN on Friday, first trim for ETHU which is 68% of my account right now lol. They say go big in the best trades and we took advantage of this ETH move in a big way, thanks Bracco. Plan is to keep this buying power available for Episodic Pivots, Earnings Breakouts, or planned focus list setups.

Weekly outlook, Last week was euphoric you could say, but not in a bad way or contra way. It seems as though everything is working and traders are getting rewarded for involving themselves in anything and everything. Gave reminders throughout the week about making sure you know what you are trading and why. Making sure that we are not losing sight of repeatable processes that build our trading foundation. Can be easy to jump to the new shiny shit co without knowing why you are buying it. Stay intentional!

I will be watching gappers throughout this earnings season and building the Q3 list. The best trades have been earnings, news, or theme driven setups. Between those, and classic high quality technical setups we can remain aggressive. I do think most of the best names are beyond buy spots but still see setups worth acknowledging. I want to be long at the top. This means I was pushing it and trading my best when the market was rewarding. If signs of change start to come we know how to react, but it needs to be more than 1 day or 2 days. Stocks have earned the right to consolidate, yet more and more continue to rip. These are the times we dream of and read about in history books. Capitalize.

Charts Covered - RDDT TAN NXT SE AVAV NBIS LCID

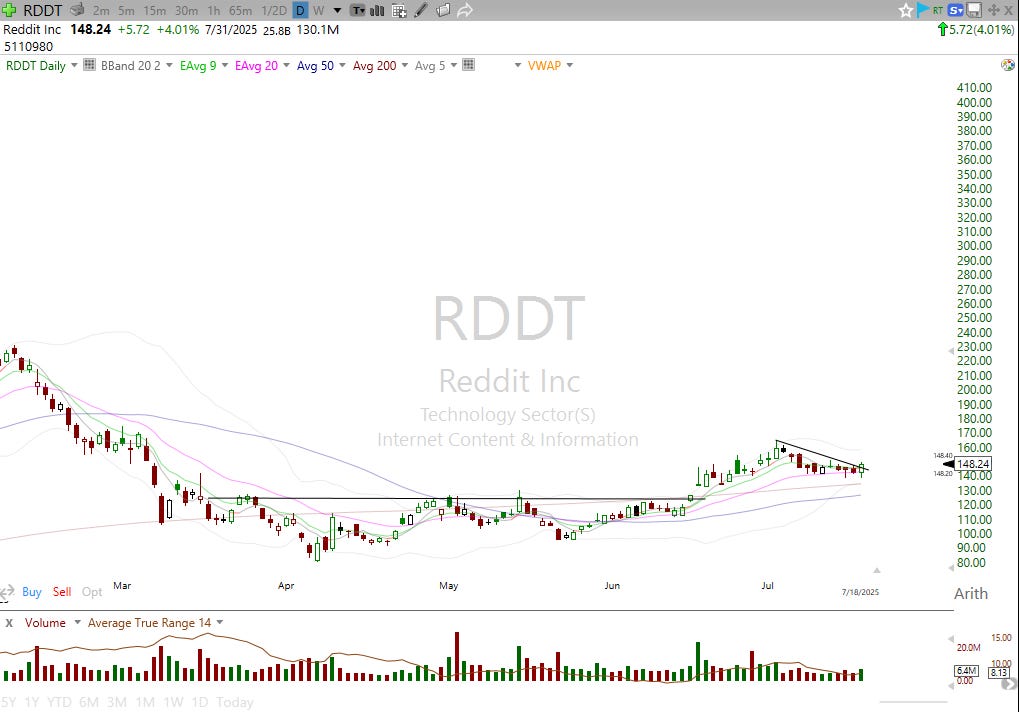

RDDT (Daily)

Signaled on Friday and behaving as mapped out in last week’s post. The shakeout under $141 into $138 held and gave a GO SIGNAL. I was managing and monitoring positions on Friday with no intention of buying on OPEX so i do not have a position in this yet, although I should. I would love an inside day tomorrow to allow me to better enter the stock.

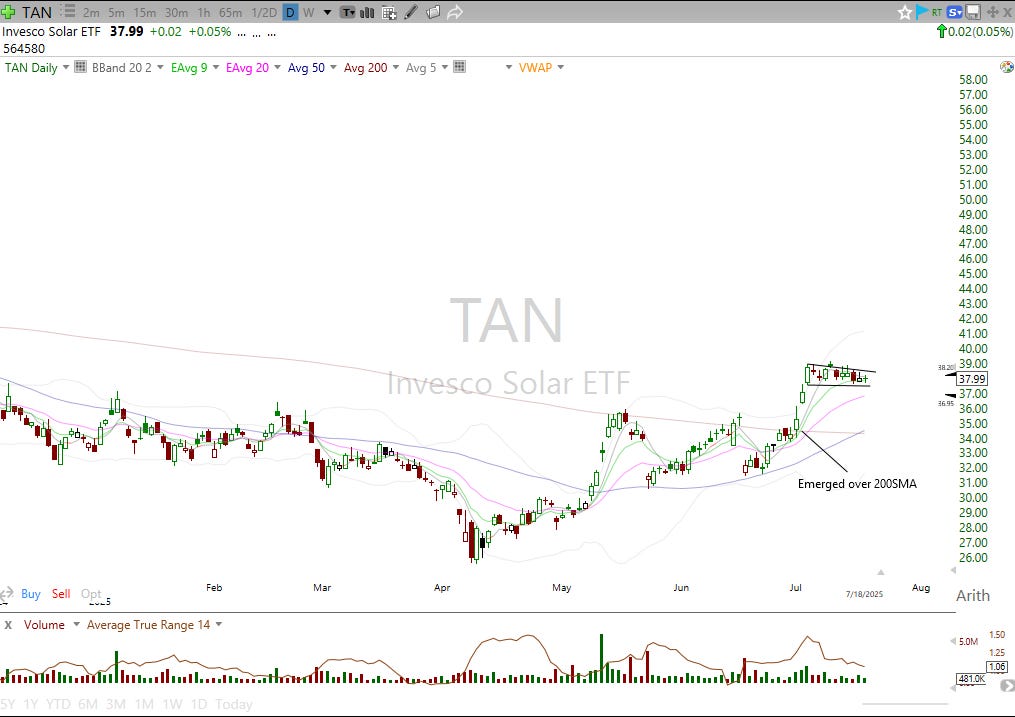

TAN (Daily)

Solar ETF I think can be something to monitor along with NXT FSLR SEDG. High Tight Flag here after reclaiming the 200SMA for the first time in a year and really the first sustainable remount since late 2022. Take this with a grain of salt as the group has been a major laggard and horrible to trade. But when they move, they can really push.

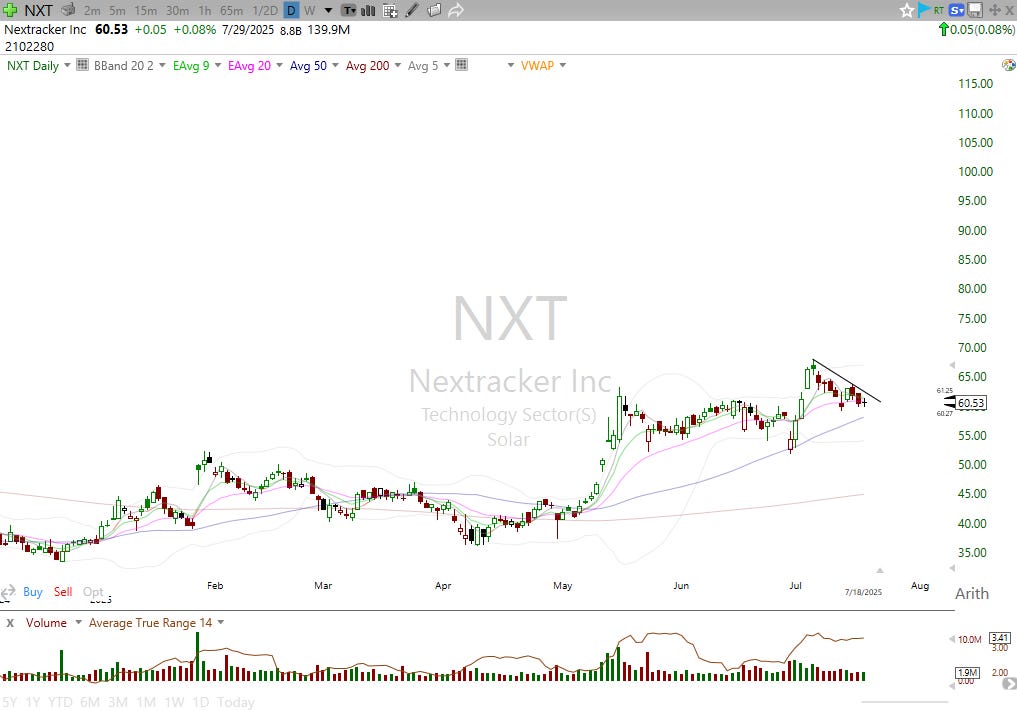

NXT (Daily)

The strongest solar name, however FSLR & SEDG are “better traders”. Looking for this to remain tight in this flag hanging around the moving averages. The want to see it push over $64 and hold. Would expect the move to grind into the high $70s, low $80s.

SE (Daily)

This was one my radar but chose to ignore due to the high beta moves we have seen in a variety of other stocks. But I really appreciate the pullback and push over the past 5 days. This will be closely monitored for sideways action to occur above $160-$161. Would expect it to tighten and then make another advance to $200+.

AVAV (Daily)

Tradingview chart because TC2000 is down today! very sad. AVAV remains on the list of actionable setups this week. Another one I wish I was in, so I will continue tracking it for an opportunity. Any consolidation up here on the daily and a tap of the 9EMA to hold and I will take an attempt. I think this has potential for $350.

NBIS (Daily)

Started Monday with a big gap up after a weak close on Friday. This is a classic kicker candle. Add in the undercut of the range and 20EMA this makes for an actionable trade on that gap up. Put this in your playbook! Now we have consolidation under the ATH breakout spot just above $55. If this triggers again over highs I think we see NBIS make a near parabolic push into the $70s.

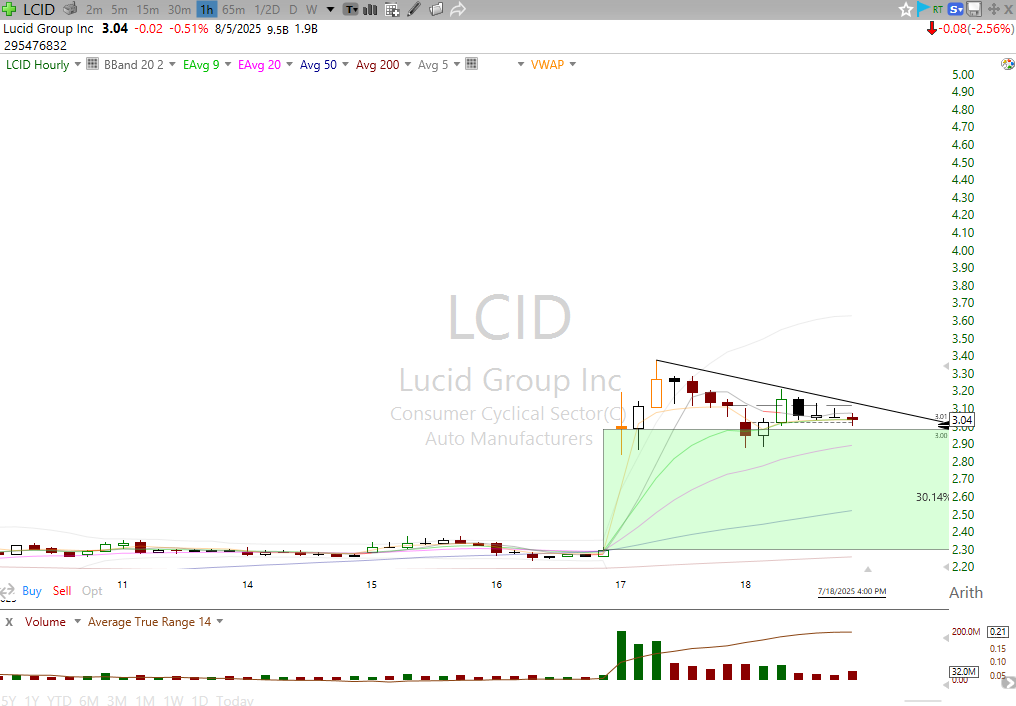

LCID (Hourly)

EP (Episodic Pivot) behavior on Thursday’s gap up on UBER partnership. Thursday was LCID’s HVE (Highest Volume Ever) day. The close of that candle is $3.12. If we see Lucid hold $3.00 and $2.85 and push through $3.12 then I think this can really push higher. Would expect a move to $4.50 and $5.50. The options pricing seems incredibly reasonable given the move on Thursday. $4C for November are $0.37 and $5C for December are $0.26. Given the potential of a change in character on the stock, this seems like a decent possibility.

Broader Watchlist - When TC2000 boots back up (hopefully later this evening) I will send the TSDR Top 20 in the discord!

This is the list I scan throughout the day and choose my focus list from after hours or premarket news and 3-4 from this list that are IN PLAY that day for action.

Closing Comments and Mindset

Important to pay attention to news and earnings gappers. These are frequently the best trades to be in. Whether it’s MP RGTI or TLN which just occurred over the past 6 sessions. We want to be ready in the morning for what is in play. Excited to see what EP’s come our way!

I really encourage folks to go back through some of the past five Sunday Scans post and check out the results of the ideas and market commentary! We have had a great pulse on the market and what stocks to be involved in.

It is slightly harder to justify new positions as I think the market continues to show it’s hand as to what it has picked as leaders and winners. Happy to be positioned in what I have and enjoying this market. Will continue to take triggers and setups as they signal. I welcome a pullback if it comes. Pullbacks to the MAs during a strong market are natural and provide opportunity. Positioned heavily in stocks I like, didn’t update today my long term holdings but man it’s been awesome! We will be on zoom everyday and active in the discord chat monitoring the market and whatever it decides to do. Ready, Engaged, Focused, Aggressive but Patient.

Let’s have another amazing week. We are ready!

Great info. My ETHA trade is up over 30 percent thanks to you guys! Miss the Sunday Scans summary.