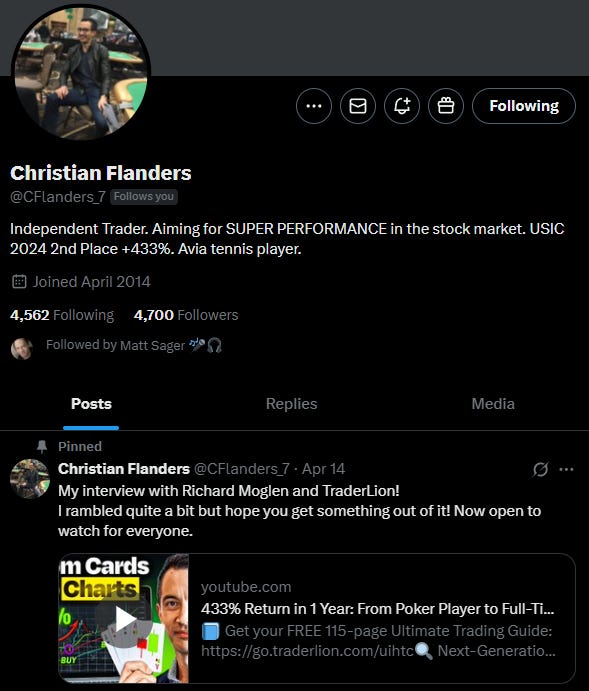

Big news! We are hosting Christian Flanders for an exclusive interview for discord members on Tuesday at 8PM EST. He finished 2nd place in the 2024 United States Investing Competition with an outstanding +433% return. Very excited to chat with him and learn from his process and experience. One of the best traders around and a great resource to learn from and grow.

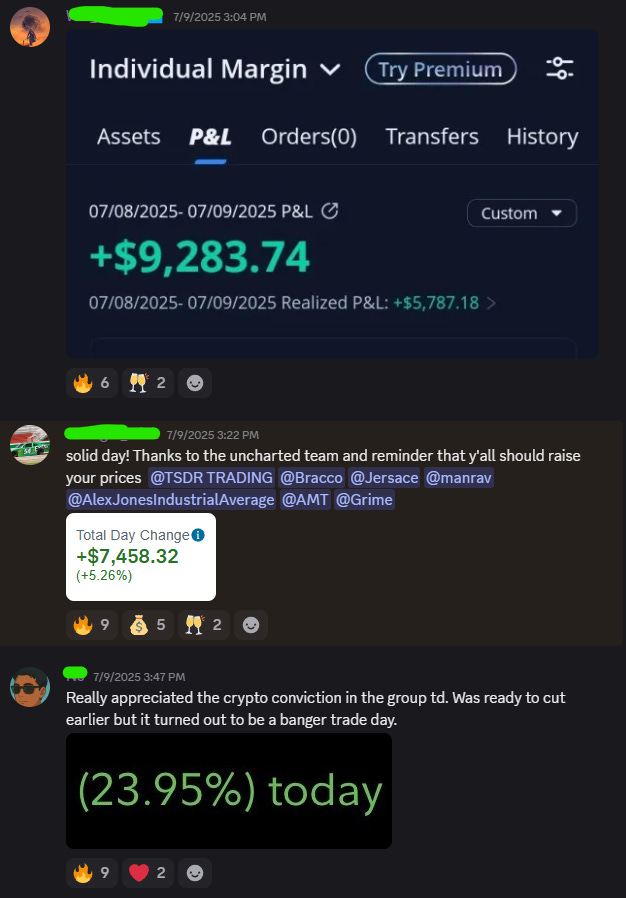

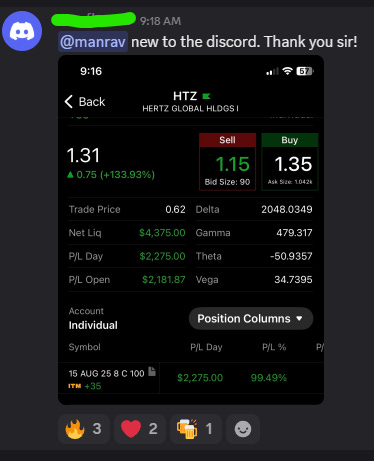

Uncharted Territory crew, grateful for all the effort that is put in everyday! A lot of hard work goes into finding ideas, teaching, executing, and managing trades from entry to exit. Happy to have awesome traders that we get to engage with from open to close!

Want live commentary, alerts, access to Bracco & TSDR, and a strong community of of 400+ committed traders?

Join the Uncharted Territory Discord using promo code “SUBSTACK” for a Great Lifetime Discount!

WHAT WE WILL COVER

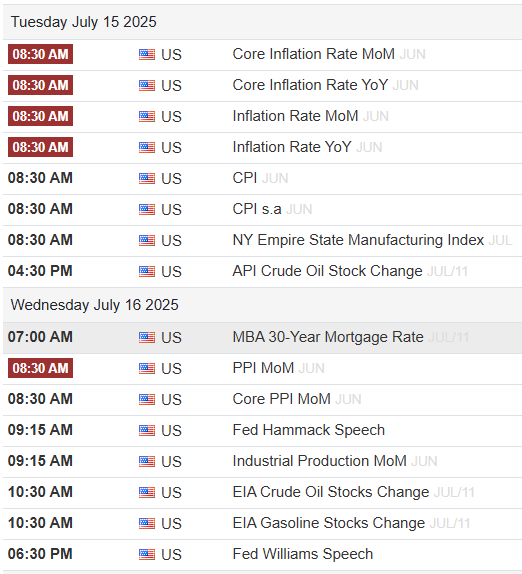

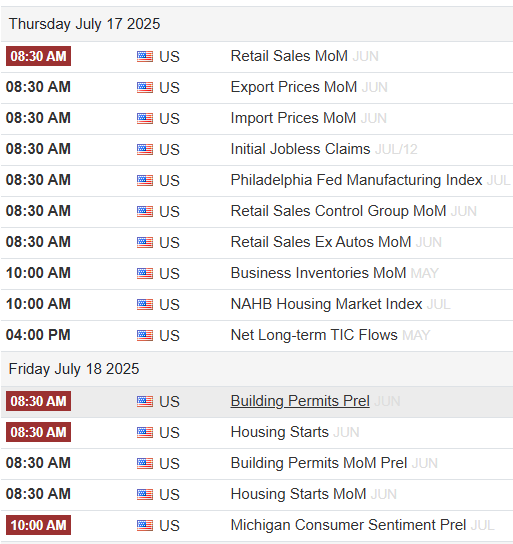

-Schedule for the week of economic data and earnings

-Market Breadth Data and Internals

-Index and ETF Analysis

-Bracco’s Breakdown and Top Ideas

-TSDR Weekly Outlook and Watchlist

-Closing Comments and Mindset

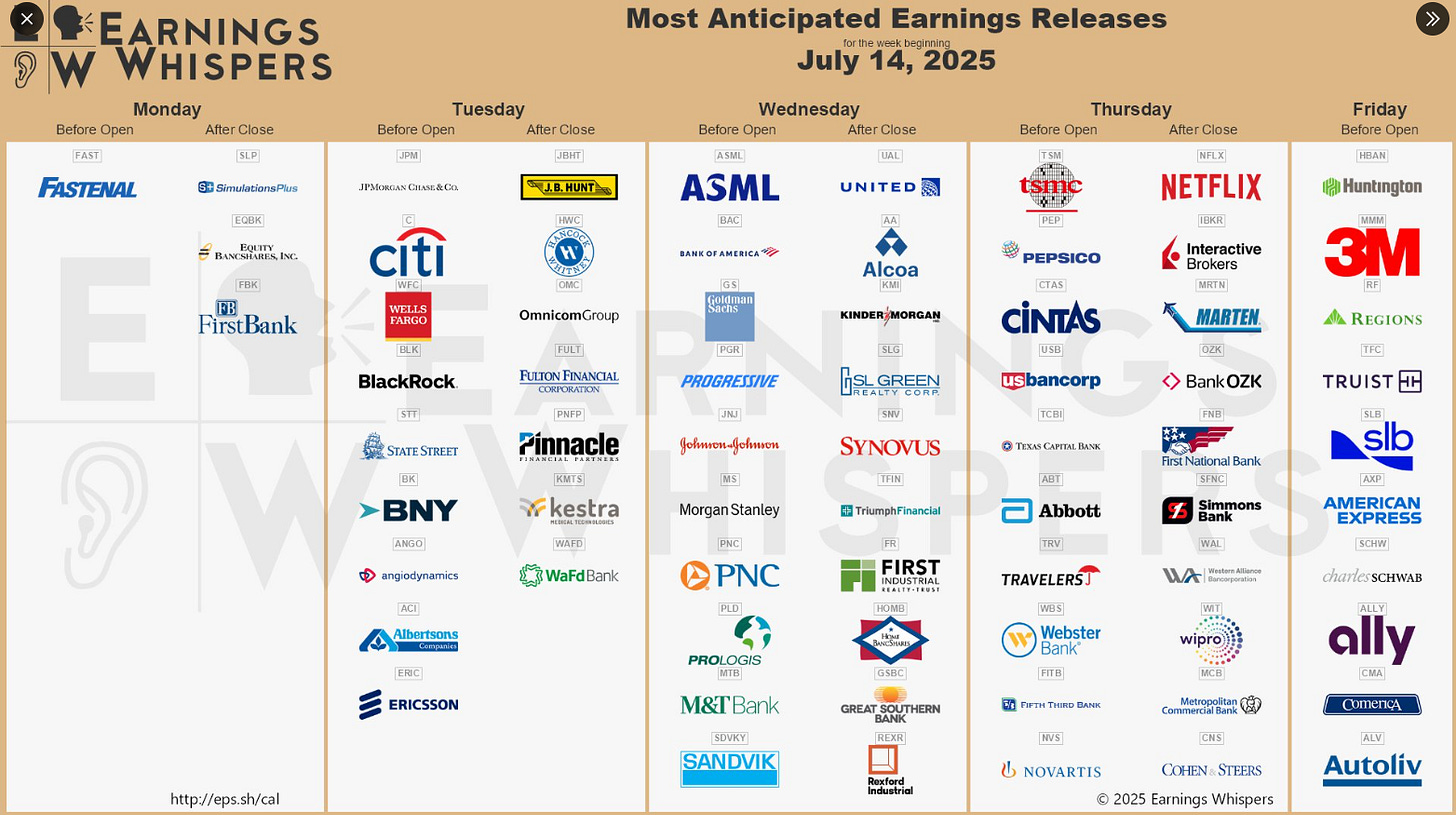

Earnings & Economic Calendar for the Week

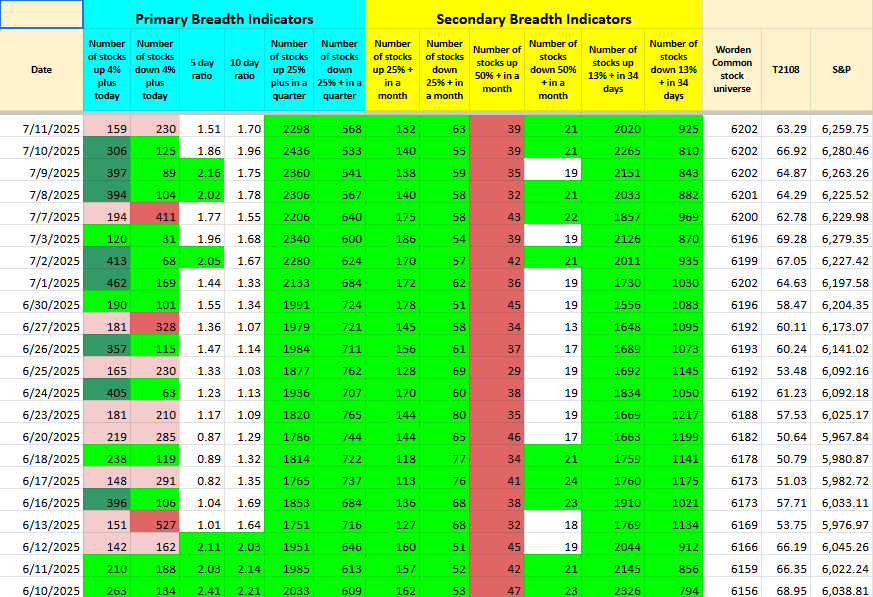

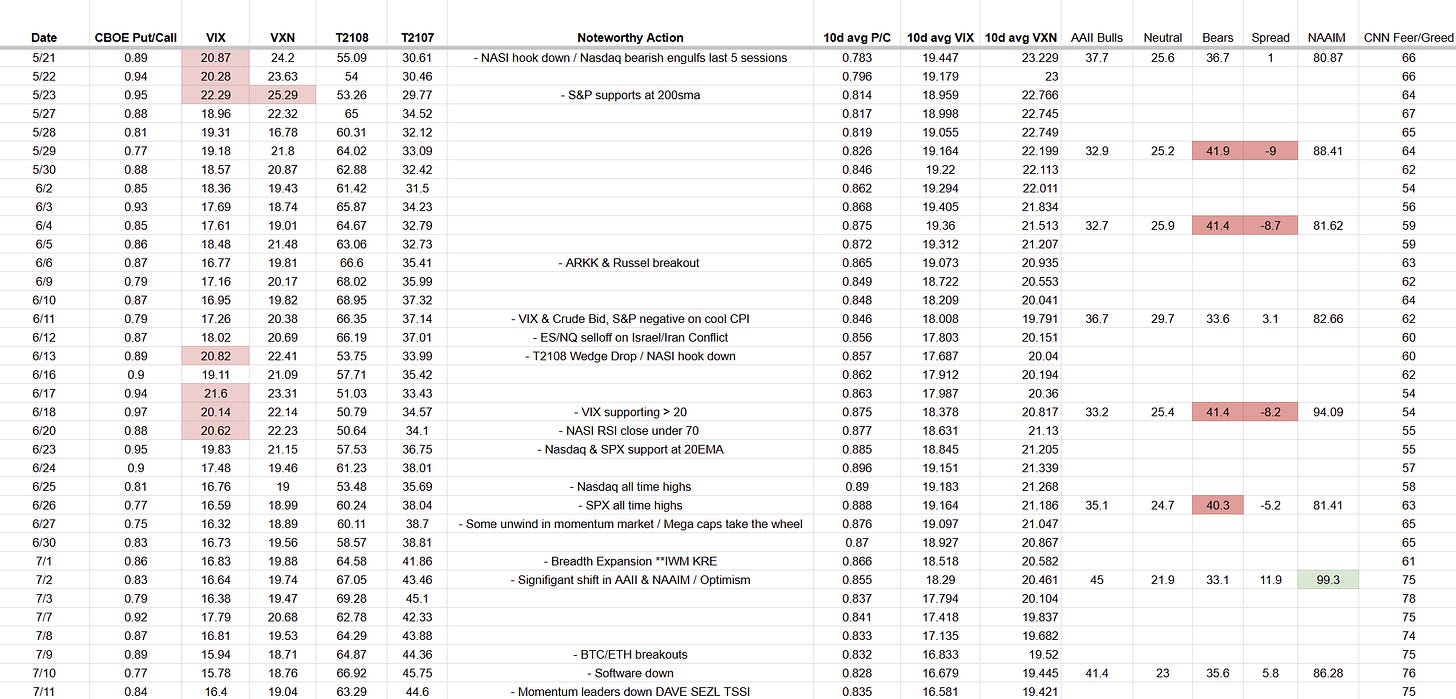

Market Breadth Data

StockBee (Pradeep Bonde) Market Monitor

Bracco’s Market Health Tracker

T2108 (% Stocks Above 40MA) = 63.29%

T2107 (% Stocks Above 200MA) = 44.60%

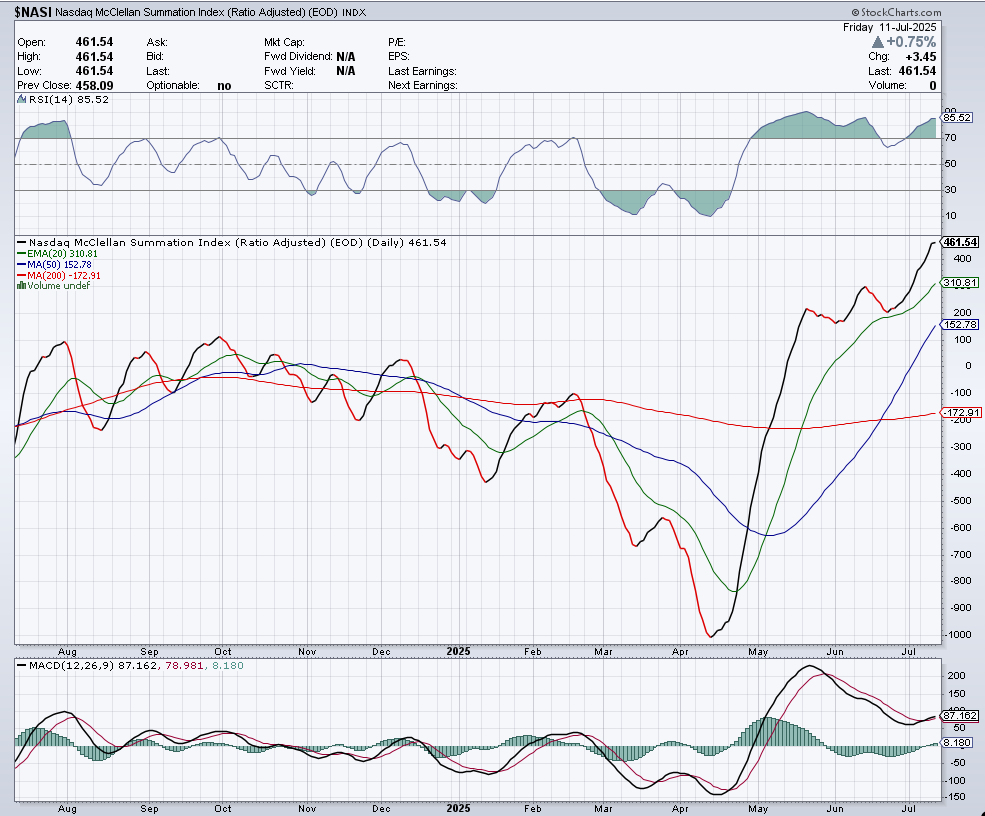

NASI

Index & ETF action, hourly levels, and insights for the week ahead

QQQ (Daily Chart)

Market chopped essentially for the entirety of the week. Opened with a gap down on Monday at $553.61 and closed Friday at $554.20 with not much in between. In fact it is the tightest dollar range for a week since early May of 2024. At the index level, not much to make of it and wouldn’t be surprised to see it continue. The Nasdaq has closed below the 9EMA only five days since this trend started on April 23rd (54 Sessions) with Zero closes below the 20EMA. This continues to guide my bias and approach to finding ideas. I do not know what happens here and would not be surprised to see continuation, further consolidation, or pullback. Plan is the let each day play out and rely on my watchlist and trade results to tame or push aggression. Would welcome any pullback as opportunity and further trend as continued participation.

QQQ (Hourly)

Added in two new levels, $553 and $557.15. The first areas of support at $550/$551 held on Monday with no hourly closes below this spot or the moving averages. Bulls are still filling bear gaps, but increasingly, we have seen bears closing bull gaps quickly on overnight strength. This has contributed to early session volatility and chop.

ARKK (Daily Chart)

Cathie Wood’s flagship ETF continues to be one of the strongest areas of the market. Big moves this week from COIN AMD U CRSP PRME & SOFI contributed to the outperformance this week. ARKK has not closed below the 9EMA since it’s “KICKER CANDLE” Breakaway Gap on June 6th. Pullbacks I want to see the 20EMA continue to hold and on the weekly consolidation above $68.50. Otherwise I have no reason to believe this won’t trend up to $75-78 level. Say what you will but this ETF is up 90% from the April lows and the stocks within have been some of the best winners. This is something that needs to be monitored on the Daily and Weekly timeframe for months to come.

IWM (Daily Chart)

Back above 200SMA and has shown some outperformance to QQQ recently. Looking for the $218-$220 area for a trade via TNA or IWM calls.

SMH (Daily Chart)

Semiconductor ETF continues it’s outperformance and leadership this week. Hitting new all time highs again on Friday. SMH has closed below the 9EMA two times since the trend began on April 23rd (54 Sessions). The strength has been remarkable with many stocks that have been dormant for eight months to a year participating in a big way. And of course, NVDA leading the way becoming the first ever company to hit a $4 Trillion market cap this week. Eventually these will consolidate, yes, but we read PRICE and as long as this is acting the way it is, then we have no evidence to call the completion of this move.

BTC (Daily Chart)

Bitcoin was undoubtedly the main winner and standout from the week. Traded extremely tight into Monday and Tuesday readying itself for the breakout and follow through in the second half of the week. New all time highs and price discovery, expectation is for this to continue into $125K-$130K before its next consolidation. Sitting comfortably in a variety of crypto stocks as well as Bitcoin outright. No FOMO here and if not in would suggest waiting for some tightening.

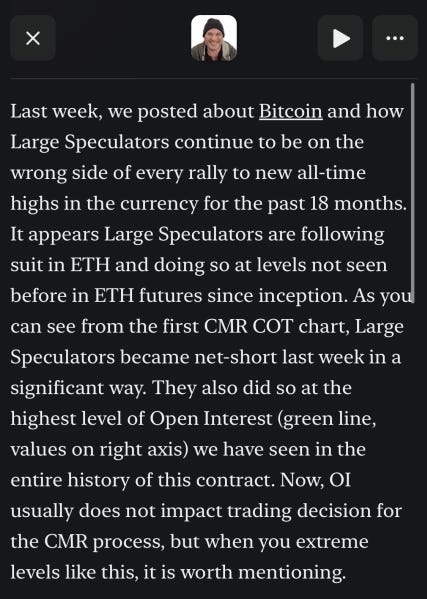

ETH (Daily Chart)

Our group originally drew interest to Ethereum after a post a few weeks back from Jason Shapiro (Crowded_Mkt_Rpt) on X. He discussed how large speculators became net-short Ethereum at the highest level of Open Interest we have seen in the entire history of the contract. This made Ethereum an intriguing vehicle for any sort of crypto run as the negative positioning and sentiment could fuel an explosive move higher. Not to mention the clean base and pivot setup into Tuesday and Wednesday last week.

Bracco’s Breakdown & Top Ideas

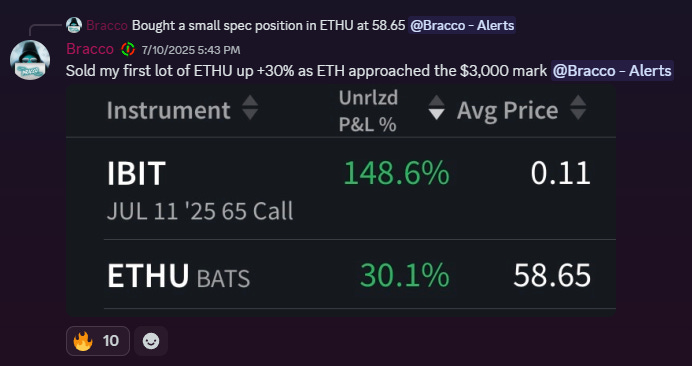

My first week back from vacation was a success. The timing of my return couldn’t have been better, coinciding with clean breakouts in both Bitcoin and Ethereum—opportunities I was able to participate in. While I wasn’t positioned to take on anything with aggressive size this week, as I mentioned last Sunday, my priority was simply to stack up a few base hits and get back in sync with the market, which I did.

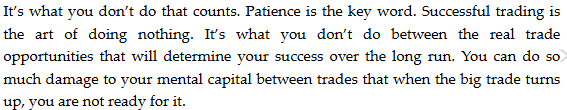

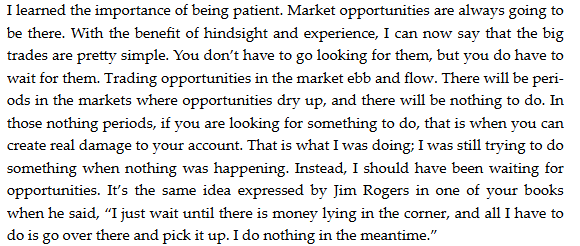

At the moment, I don’t have any strong opinions on the market. I used the weekend to catch up on unfinished projects in my Evernote and tuned into the 2025 Trader Lion Conference. The opening interview featured Jack Schwager, the renowned author of the Market Wizards series. Schwager highlighted a trader from his book “Unknown Market Wizards,” Amrit Sall, whose approach really sparked my interest.

After hearing Schwager’s comments, I downloaded the book and dove into the chapter. If I had to choose one trader who resonates deeply with my own trading philosophy, it would be Amrit Sall.

Known as "The Unicorn Sniper," Amrit Sall is known for his disciplined and highly selective trading strategy. He focuses on rare, high-probability, asymmetric trades—what he calls “Unicorns”—where the potential upside vastly outweighs the risk. Over 13 years, he’s achieved an average annual return of 337% with minimal drawdowns after his first year.

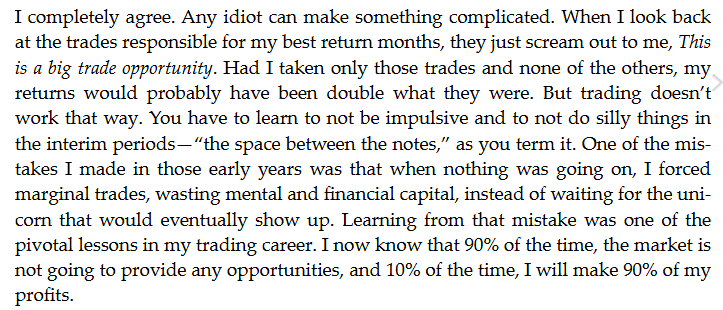

A few great quotes I saved from Amrit Sall:

This chapter, which I read three times in one day, inspired me to reconnect with what has always driven much of my success: sitting tight and waiting for those fat pitches. I’ve always been very gifted at identifying and capitalizing on those big, asymmetric trade opportunities. For example, I stayed up all night on Sunday, April 6th, in preparation to go all-in, fully leveraged long ES futures the next morning when everyone was in complete panic. Based off my studies, I considered that moment to be a once in a decade type opportunity. It ended up being the biggest trade of my career thus far. This approach of mine was originally inspired by the philosophies of George Soros and Stanley Druckenmiller, who emphasize capital preservation and high-conviction, concentrated bets. Druckenmiller famously said, “put all your eggs in one basket and watch that basket carefully.”

Soros and Druckenmiller are known as investors, but I think their philosophies translate seamlessly to trading. There’s real skill in sitting tight, avoiding mediocre setups, and waiting for the best opportunities. It’s not easy to watch the market all day and do nothing, and I still catch myself overtrading on subpar setups at times. For the second half of the year, my focus is on what I do best: those rare, asymmetric bets. I have hundreds of models, trade write-ups, and reviews saved in Evernote. This practice helps train the eye to recognize what these big opportunities look like and to act with no hesitation when they present themselves. I know exactly what my “Unicorns” trades look like—it’s just a matter of patiently waiting and doing nothing in between.

TSDR’s Weekly Outlook & Watchlist

Current Positions - COIN ETHU SLV IREN SMLR ASML CRDO NBIS STNE TSSI LMND KWEB

Update, NBIS TSSI LMND were drags this week, I am managing the remainder of my position on the weekly chart. Any further weakness and I will close the remainder. They are all trimmed with significant profit which allows my conservative management of the trades. My size has shifted from those into COIN SLV ETH ASML. Still really happy with what I have and looking forward to removing the smaller sized remainder positions to make room for convicted new trades.

ETHU SLV ASML were directly from last week’s newsletter and taken as planned, major winners for the week. CRDO hit all time highs on Friday at $100, up $30 from my $70.70 buy. IREN just consolidated after it’s 70% move, I remain long from $10.42 and have trimmed into strength. KWEB was disappointing on Friday seeing China strong and then close weak, any weakness on Monday and this is out of my account and back into the watchlist for another shot later on.

My approach, I am happy with my approach and performance although I freely admit I could be more aggressive with some of my ideas that come up throughout the week. Over the past two weeks I have highlighted charts and triggers of the biggest winners and failed to act on some of them. FUTU ENVX RKLB JOBY xxx to name a few. My goal is not to catch all of them obviously, but I could’ve and maybe should’ve completely moved on from NBIS and others as they showed signs of weakness to make room for the the thematic winning trade ideas. I say this and it is also unreasonable to be upset because I have captured some of the biggest moves fully on this like COIN CRCL NBIS NVDA and many others. I just always look for areas to improve my edge. In fact, this is the best performing market cycle of my 7 years of trading. This is 100% because of this mindset of always looking for improvement to sharpen my trading skills and self awareness.

Weekly outlook, we are starting to see some cracks under the surface in names like SEZL DAVE CRWV CRWD and others that have been the biggest movers of this rally. Groups like cybersecurity, software, and quantum are losing steam with fairly harsh action towards the end of the week. However, the semi group is still phenomenally strong broadly, I will continue to use this as a main indicator for signal. I am certainly mindful of the signs the market is giving, now waiting to see if some more comes of it or just another false start. Caution is fine when warranted, but detrimental when overweighted. Yet to be determined so I will continue to rely on my watchlist and trades.

Charts Covered - RDDT AVAV USAR VNET HNGE MU

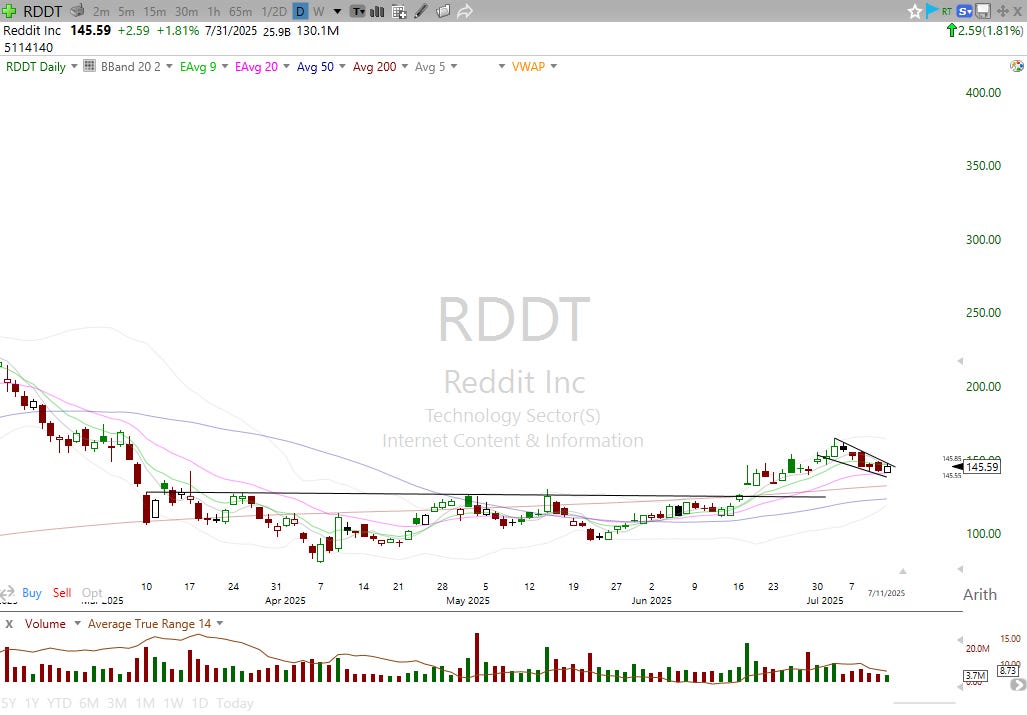

RDDT (Daily)

I really appreciate the low volume of this six day pullback into the 20EMA. Inside day on Friday. $141.30 3 day support low. Two scenarios possible, Break inside day high of $147.40 and trend towards recent highs or undercut and reclaim $141.30 with a stop at the new established support.

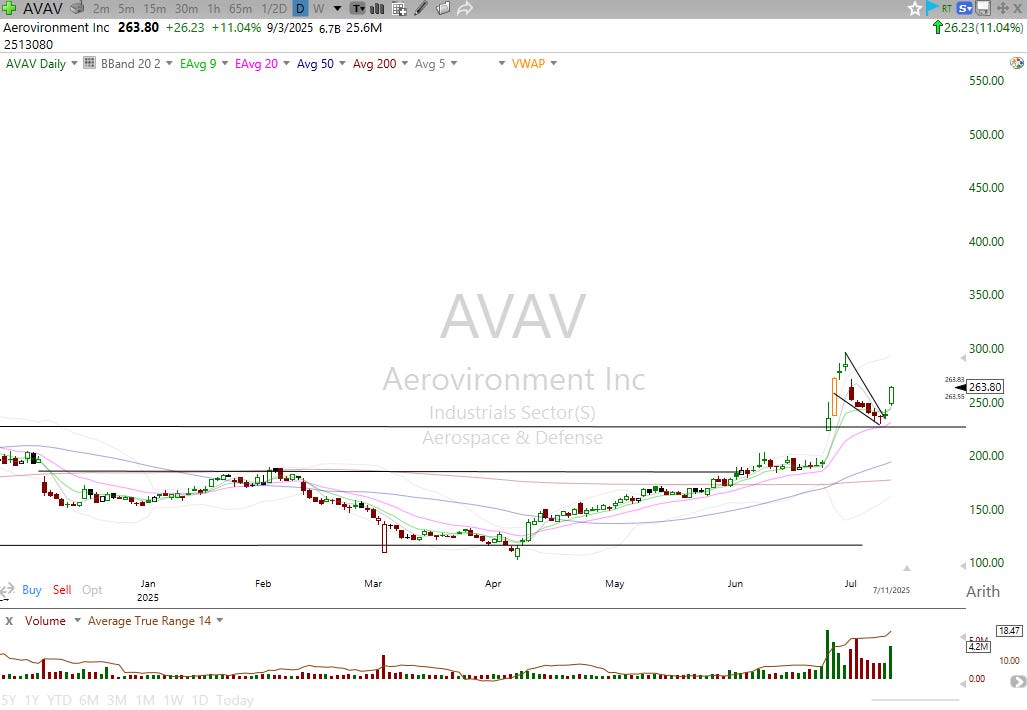

AVAV (Daily)

Earnings breakout and follow through. Pullback and hold of HVC (High Volume Close). Remount of moving averages on drone headline from The White House. Initation on Friday news was reasonable. Now watching hourly for some tightness to form under $270. This has major potential given the earnings, theme, news, volume, and weekly chart. Take your shots. All of these drone stocks are a focus and all look primed.

Drone stocks: AVAV KTOS UMAC RCAT AIRO ONDS

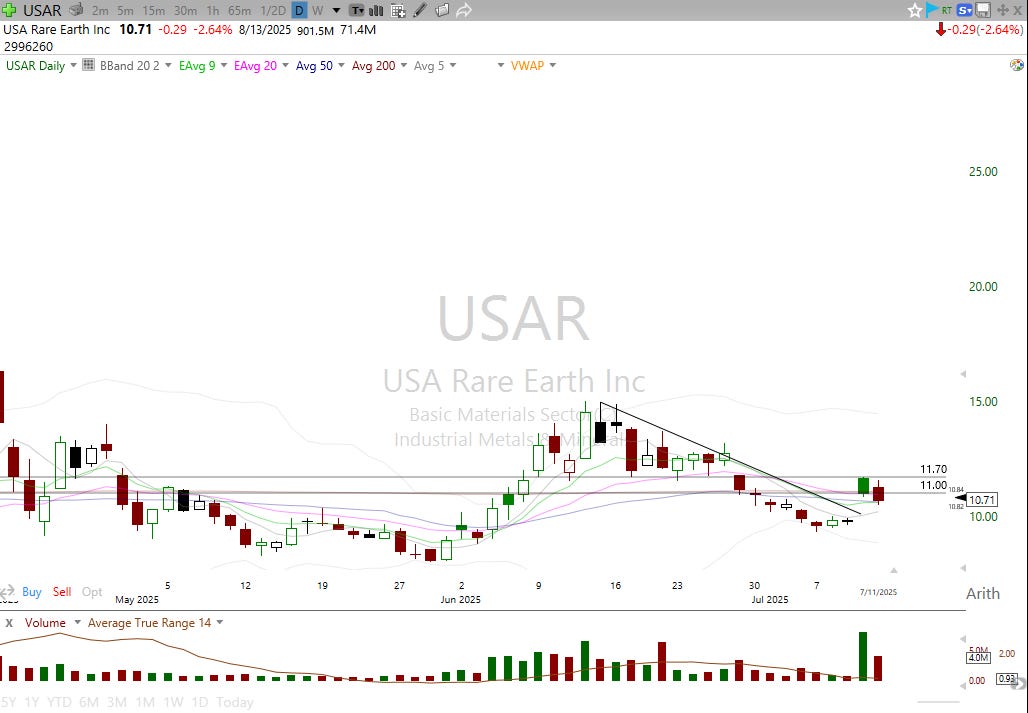

USAR (Daily)

Much more of a speculative idea and a longshot. News on MP Materials on Thursday surged the stock 50%. Will have an alert set at $11 and $11.70 to see if this has a delayed move. QS is a recent example of a delayed move on news. If USAR breaks those levels I think a push to $15 and $18.5 is possible. Again, more speculative and need those triggers to signal entry and maybe MP sparks a theme in these stocks.

Rare Earth/Minerals: MP CCJ LEU USAR ASPI UUUU UEC CRML CMP PPTA UAMY (some are multi-themed with Uranium)

VNET (Daily)

Impressive strength on Friday following a pullback into the MAs and the base structure. Accumulative volume pattern coming out of the base. Want to see a day or two of rest under $8 nice and tight to get involved.

HNGE (Daily)

New attractive IPO, and I think Friday really showed it’s hand. Light volume on the sell/consolidation and another high volume advance day. $45-$47 near term area to hold for momentum. Buys sub $44 seem viable but idk if it’ll allow that.

MU (Daily)

Positioned in ASML and a few other semis in long term account. But watching this consolidation closely. One of the strongest semis coming out of year long base and looking for higher low to continue it’s trend. Dip under $130 and 20EMA that fakes below is actionable.

GOOGL (Daily)

Wish I was in this off the 200SMA hold. The remount and hold of the 200day has been a very reliable setup and area to risk off recently. $181 is a big resistance level for GOOGL to break. Would love a weak open on money and an inside day or red to green to get involved.

Broader Watchlist- UMAC AIRO RCAT VNET AVAV HNGE ETHA IBIT RDW FUTU SLV ASTS TLN MSTR SANA CCJ CEG POET RDDT GRAB INSM ENVX NET URBN DAL POWL WRBY ASML AS ULTA BA AAOI INVZ ASPI MU CAR TSLA AMZN CRDO UUUU GOOGL AMD COIN ETSY KWEB URI CMG SE GEO U DELL CIEN CART SMLR HUT Z ALAB CPNG CXW DE META PCT AMSC OUST TEM ATAI RUM DKNG WRD AEHR BKSY URGN JMIA NKE USAR VSAT JOBY SMCI TIGR GH TOST SYM NXT AIP WULF IREN SOUN CIFR SEDG TSSI HSAI

This is the list I scan throughout the day and choose my focus list from after hours or premarket news and 3-4 from this list that are IN PLAY that day for action.

Closing Comments and Mindset

Really excited for Earnings Season to begin this week. Per usual, we will keep an organized list of Earnings Surprises and Gappers to track throughout the quarter. We have a lot of stock specific, economic data, and Trump stuff in the headlines. I plan on starting the week slow and taking it day by day. I will be actively scanning through my broader watchlist of stocks looking for standout setups, relative strength, and themes. I will be looking for consolidation and pullbacks in notable names for opportunity. I will be monitoring my positions closely and making adjustments when necessary. Crypto, Silver, and Semis are important to have on the screens to see their performance and impact on the market. I will continue to take stabs at reasonable spots and see what sticks around in my account. I will execute with confidence when my setup triggers, place a stop loss where it is invalidated. I will continue to look for massive 5-Star Setups like IBIT COIN ETH SLV recently. When these are presented, you must block everything else out be ready to be ready.

Great read per usual, let’s get another week under our belt and make it count 🫡

Guys this is a lot of work to put together which I thank you both for. Bracco those are some great quotes and thank you for sharing them. Have a wonderful week!