SUNDAY SCANS

August 31st, 2025

Good Afternoon, We hope you are enjoying the extended weekend and enjoying some time away from the markets or using this time to accomplish some goals and backend work for your trading. A good chunk of extra time to read that trading book you’ve been putting off, building that model book you know you should, reviewing your trades and daily watchlists looking for additional insights, or reverse engineering the monthly top opportunities the market provided to try and be involved in the best movers. Many ways to use this time to Sharpen Your Trading Skills.

Shameless plug, but I truly believe our community and group we have developed is something special. Extremely grateful to our team of traders and community for their focus, hard work, skill, effort, knowledge, experience, and openness. I truly look forward to interacting everyday and learnings something. While also sharing our lessons and education knowing that today might be a lightbulb day for someone out there. Excited to end the year strong and navigate the market.

Make sure to check out the GIVEWAY down below for Substack readers.

Want live commentary, alerts, access to Bracco & TSDR, and a strong community of 400+ committed traders?

Go to our website and check us out! Use code “SUBSTACK” for 15% off forever.

GIVEAWAY - Winner ( nickperaita21@gmail.com ) DM us on here to get your FREE DISCORD ACCESS!

If this post gets 30 Restacks & 30 Likes then we will giveaway One Annual Membership access to the Live Trading Discord Server. If it gets 100 Restacks & 100 Likes we will giveaway THREE annual memberships to the Discord! (current members can win too)

WHAT WE WILL COVER

-Schedule for the week of economic data and earnings

-Market Breadth Data, Internals, and Seasonality

-Index and ETF Analysis

-Bracco’s Breakdown and Top Ideas

-TSDR Weekly Outlook and Watchlist

-Broader Scan List

-Closing Comments and Mindset

Go to our website and check us out! Use code “SUBSTACK” for 15% off forever.

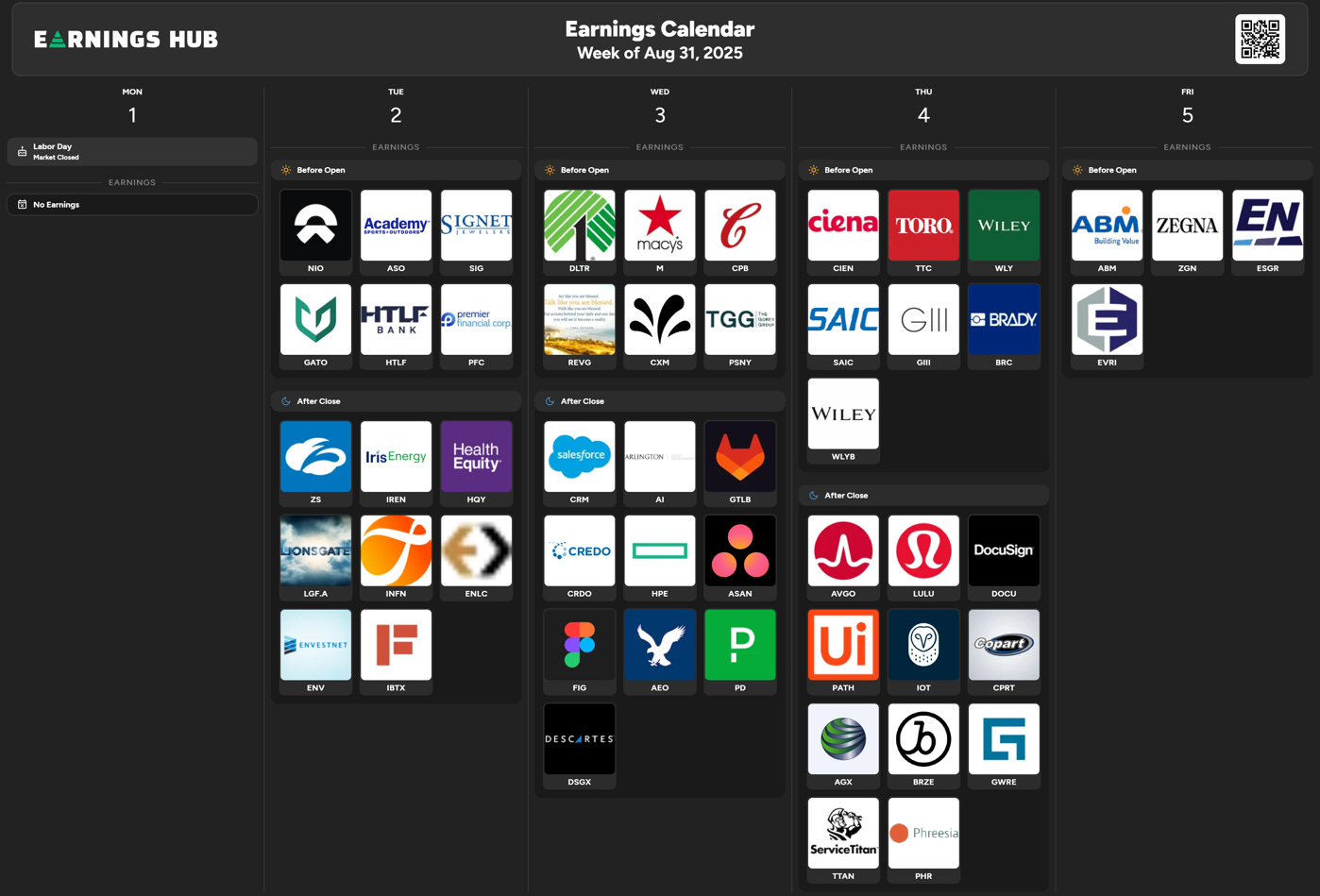

Earnings & Economic Calendar for the Week

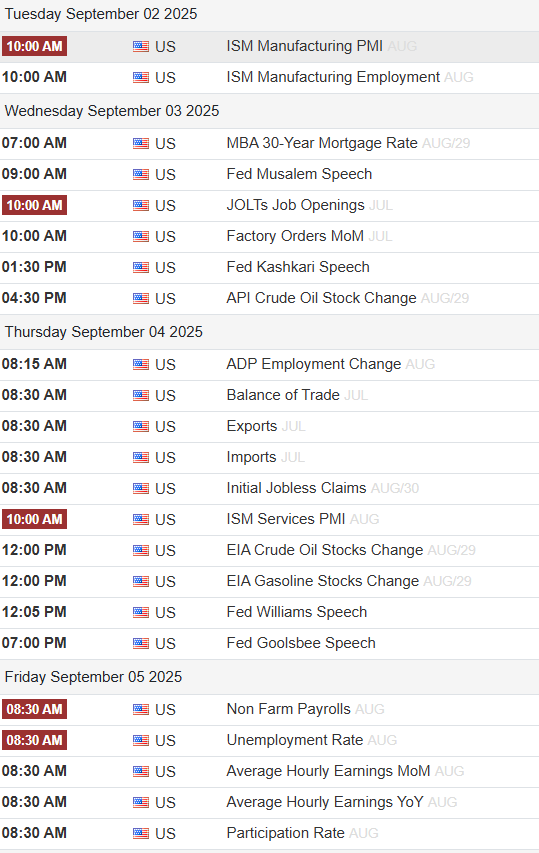

Market Breadth Data & Seasonality

StockBee (Pradeep Bonde) Market Monitor

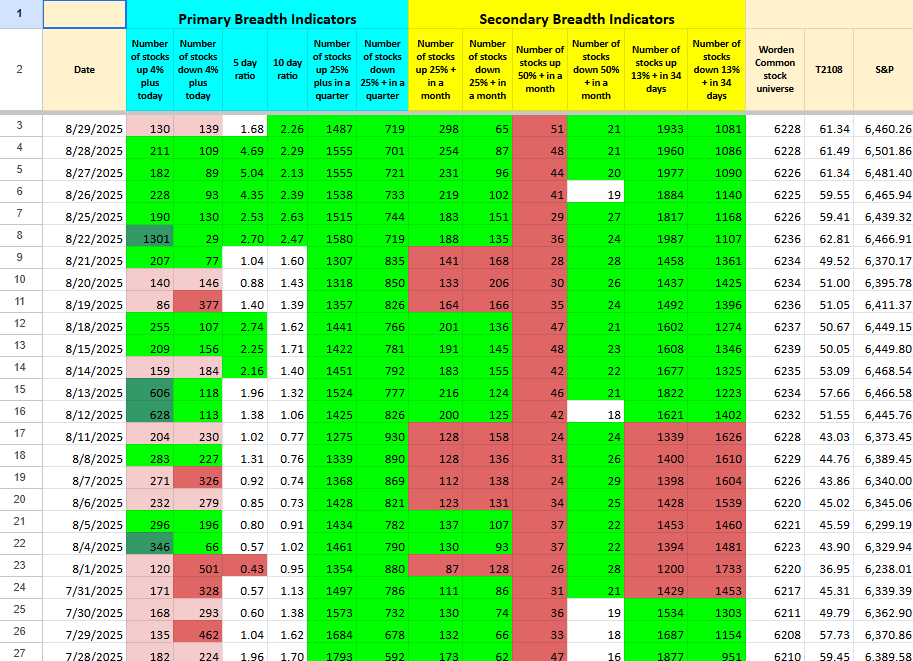

Bracco’s Market Health Tracker

T2108 (% Stocks Above 40MA) = 61.39%

T2107 (% Stocks Above 200MA) = 53.72%

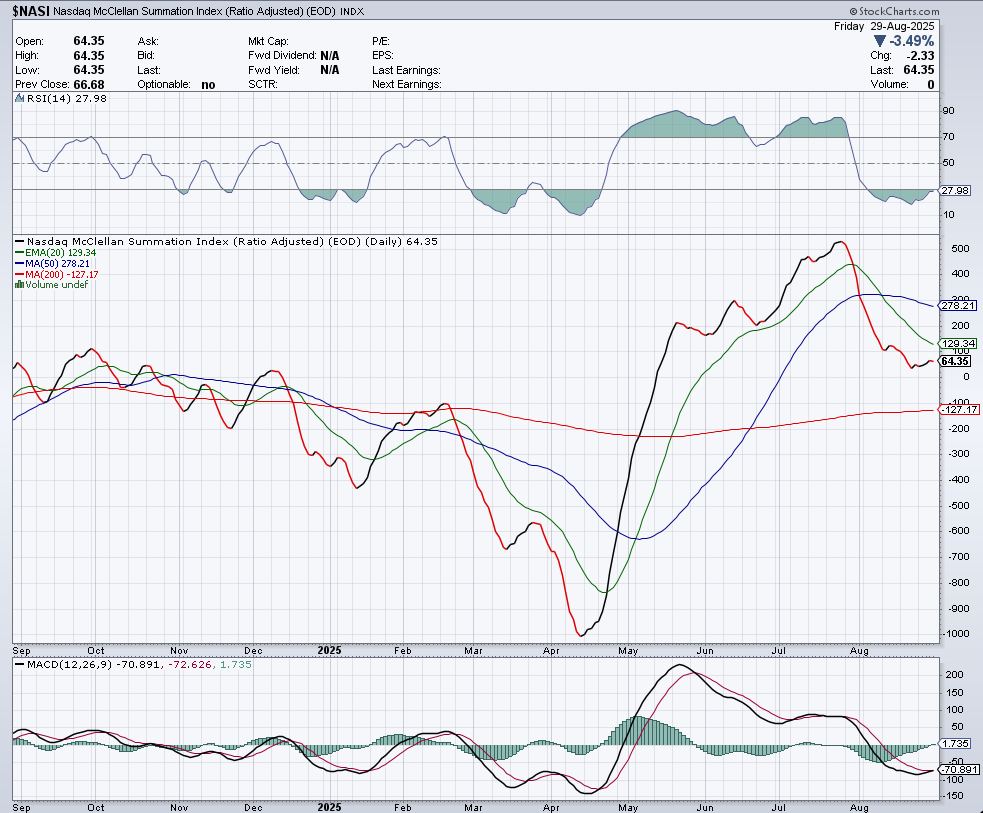

NASI

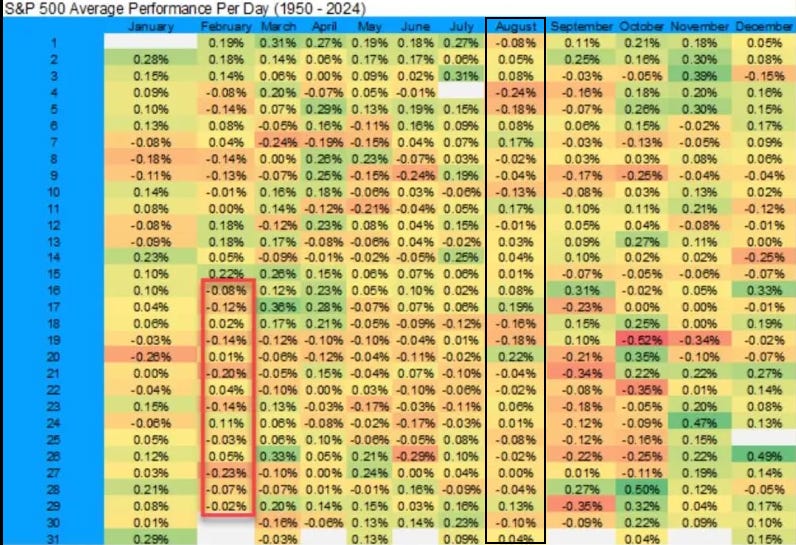

Seasonality

Index & ETF action, hourly levels, and insights for the week ahead

QQQ (Daily Chart)

Stagnant week ending down 0.27%. Early week gains given all back plus some on Friday into the long weekend. Bearish open gap above at $574.50 (the area I warned about in last week’s note). We basically have a wedge drop on the daily here along with a bearish kicker candle from Friday. Some caution is reasonable unless immediately invalidated early next week. Technically still haven’t gotten the 50SMA tap, and to be honest that is my base case right now if we lose Friday’s low. I am sure some folks see a potential bearish head and shoulders pattern beginning to form. Which I am totally cool with because the best way to trade a head and shoulders top is to buy the failed breakdown of it. This would be an ideal undercut of the 50SMA and launch. Could take a few weeks to form. The quicker the bulls reclaim Friday’s high the better in the near term. Lastly, JHOLE Friday low still critical. Important hourly levels below that we will be watching.

QQQ (Hourly)

Critical hourly levels listed in the chart.

ARKK (Daily Chart)

Five days of inside trading within Friday’s Jackson Hole upside move. another hold of 50SMA and maybe a remount is actionable. Tried some ARKK calls Friday for a possible late morning undercut and rally, but closed for -3% on the call, basically flat considering my standard options sizing. Still interested in this above most things.

RSP (Daily)

Five days also trading within the range. After breaking a 10 month base on the equal weight ETF. All eyes on Friday’s bullish open gap as well as Friday's high from Jackson Hole.

IWM (Daily)

Night and day from the QQQ chart. Can feel it on the watchlists and see it clearly on the charts. Two notable bullish open gaps compared to bearish open gaps on the QQQ. Well above the moving averages compared to compressed or below on the QQQ. IWM is the king of fake out breakouts. But seems as the though this has the juice to carry on with dips being bought at support levels below. Time will tell.

SMH (Daily Chart)

Nasty kicker candle Friday and a chart worth paying close attention to this week as a general gauge for market health. Considering Thursday a failed breakout which puts a potential right shoulder in play now. Would recommend going back and studying the QQQ daily chart from February-April last year. Looks almost identical to what the SMH is building out now. How we respond next few days will be important. Failure to close the bear gap from Friday and continued distribution above a potential flattening out 50 day moving average could open the door for a breakdown through 280/285. “So goes the semis, so goes the market.”

IGV (Daily Chart)

Adding the software ETF to this week. Following very notable earnings reactions in MDB & SNOW. Up against the 50SMA here and yet to be seen if it can push through. Some build underneath would be positive, a break lower would put this group back out of play. Right now just MDB and SNOW on the radar for stocks within the sector. Some others tracking ZM CDNS ZS SNPS.

DIA (Daily Chart)

Similarly to IWM and RSP the Dow Jones ETF is looking attractive and strong here. Consolidating near the highs of last Friday’s large breakout candle looking to hold trend and gain momentum and participation. A lot of old folks still watch the Dow and consider it “THE MARKET”.

BTC (Daily Chart)

Last week’s bounce led to two consecutive lower highs and lower lows and the 20EMA and 50SMA are curling down above price. 112K support and trying to hold the 107.5K area. Definitely some concerning action here until structure of higher highs and higher lows forms out of a base. Probably looking for a downside extension or a longer base to build for the time being. Nothing actionable just noteworthy considering BTC’s leveraged and leading nature.

ETH (Daily Chart)

Looking like an imminent wedge drop coming on ETH daily into the 50SMA. A push back to highs and tight consolidation under would regain confidence. Higher time frames and relative strength vs BTC still makes this a focus.

Bracco’s Breakdown & Top Ideas

Was very slow and boring for me last week. Took a couple small scalps, but most of my time was spent managing my IWM (long) position from two weeks ago. With end of month approaching I decided to close out my September 230 calls for a +140% profit and held onto my November and January ‘26 calls, which are still full size from entry.

Small down day on IWM Friday but still feel it’s doing nothing wrong. DIA & RSP very tight following their multi month breakouts. T2108 & T2107 breadth indicators also very tight action last week and building out some VCP patterns on smaller timeframes. If result higher should move IWM with them.

IWM/QQQ ratio with another positive week last week and no signs of stopping yet. IWM is past that 5-day burst window that I shared on last Sunday Scans, so should get some answers this week on whether this move is done or if there is still some juice left in the tank. Ultimately $240-245 area is my bigger picture target and would love to peel off some good size up there as it is a big multi-year resistance.

IWM does not typically trend very well. Most of the time it has these powerful multi day or week moves that correct sharply when finished. For that reason I am going to use last weeks low as a stop on the rest of my position. Back below that 231-232 I consider momentum gone and will likely need a lot more time of deeper pullback or basing.

Have some concerns in tech land following NVDA’s earnings selloff and semi’s really leading the way lower on Friday. Feels like lot of participants were offsides into Friday and wouldn’t be surprised to see continued selling from buyers that are trapped higher if market can’t get stage a meaningful bounce. SMH/SOXX/SOXL really going to be the charts of focus for me this week to get a better idea on near-mid term direction. Short holiday week and don’t see any reason to push the gas too hard right now unless some really big opportunities present themselves. IWM remains my only position and very few ideas on my radar at the moment.

TSDR’s Weekly Outlook & Watchlist

In the discord we offer live trading everyday, position updates, entry and exit alerts, watchlists, scanning, daily lessons, and active chat to ask questions about anything you need. Go to our website and use code “SUBSTACK” for 15% off forever.

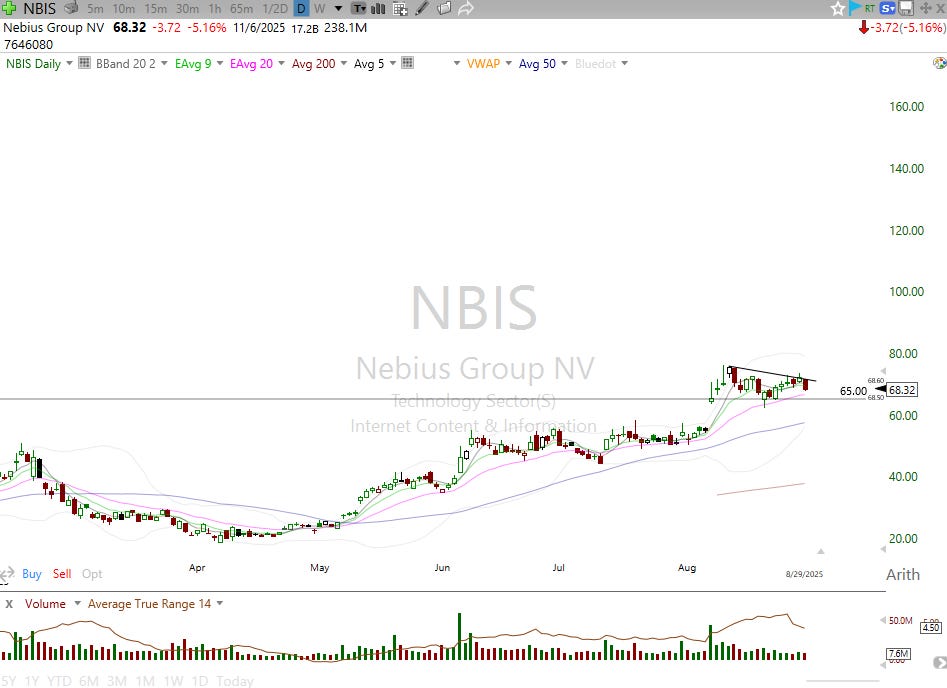

Current Positions - ETHU ALAB CRDO BE TEM TSLA NBIS SEDG BROS WULF CIFR PGY RBRK

Update, Added PGY BROS RBRK, closed USAR for breakeven, sold IWM following Bracco. Made a few intra week moves but this is what I am taking home for now! I was heavily margined which tied my hands a bit this week as my buying power was limited and locked up in my current winners. I always keep some handy for a top tier opportunity.

My approach & Weekly outlook, Feel as though I let some good moves in the market go without me due to buying power and margin being allocated in my current winners. I know that I can’t nor shouldn’t try to catch all movers. Despite that, some earnings gappers such as SNOW MDB AEHR I could have taken advantage of. Might consider lowering my max threshold going forward in order to maintain a bit more willing aggression and ability to to involve more into news gapper names as they come. Holding a bit more buying power available to keep me engaged and ready to pull the trigger vs just a manager. Additionally, I gave some progress back Friday with downside moves in TSLA NBIS ALAB CRDO ETH etc. I am fine with that but it is never fun although it’s the name of the game in swing trading. In order to catch moves like ALAB HOOD CRDO and many others I have to be willing to let the market digest while staying patient. Now, obviously, they could come all the way back right and then I would just sell at my stop or my buy price and wish I would’ve sold for 10% gains instead! But I know my plan of attack and willingness to adapt will allow me to make proper decisions with intent and not impulse. I know my trading objective and I know my stocks and my plan. Let it work or stop me out until my sell rules can take over and trail the winners.

We are through FOMC, Jackson Hole, NVDA earnings it seems as though the market has been waiting and looking ahead to the next “thing”. We have lots of labor data this upcoming week and a few earnings still sliding in, quarterly OPEX coming in mid September, and everything in between. Let the market do the talking and I will interact where and when I have an edge. I am curious about near term direction and will rely on my trades and my watchlist to tell me how much to push it. I was heavily on margin for a bit there and have since lightened some back to reduce risk and open up buying power. When one of my ideas triggers and signals entry with asymmetric Risk to Reward then I will not hesitate to execute the trade and let the stop take me out or ride the trend. That’s my job.

Some great charts below that I am watching.

Charts Covered - BROS LMND RDDT SERV SNOW RKLB NBIS VERI WULF ZETA HNGE

BROS (Daily)

Tightening would be great. I like the bounce into EOD Friday. Loved the strength throughout the week and the constant bid. Pattern is top tier on daily, weekly, and monthly. Should have taken a buy early in the week instead of waiting. But will be looking to build into as long as $65.6 holds (last week’s low). Think this has good potential for a bigger picture trade.

LMND (Daily)

Watching 52 and 48 levels below if 20EMA does now hold. If we get a buy signal near here I will take it. Strong reaction post earnings and just building out it seems. Weekly could take 2-3 weeks and be fine.

RDDT (Daily)

Holding 20EMA post earnings ramp. 226 to 230 levels above to take out. Weekly cup and handle coming into 3rd week of handle slightly off highs. All good things.

SERV (Daily)

$RR was a big mover last week. SERV boosted 14% on Wednesday to remount all MAs. Trying to build above this trend line and launchpad. Interested if it can take out last week’s high or defend $10.50 bullish open gap.

SNOW (Daily)

Highest weekly close since Feb 2022 and looking like beginning of Stage 2 uptrend now. Strong ER gap up followed by inside day Friday. Watching for a post earnings trade here. $230 and $241 areas of interest. Very interested. PSTG MDB some other ones.

RKLB (Daily)

Between this ASTS and PL. I think RKLB showing the best action. Held 50SMA and saw a nice push now building out a slight base here and higher low. $50 push confirms a new uptrend near term imo. Want $45 to hold.

NBIS (Daily)

All eyes on 20EMA reaction here. $72-$73 building flat level to break through much like the $55 spot before earnings gap up. Monster stock and has been a great winner since Nov 2024 for us. Been my “wing man”.

VERI (Daily)

Little guy but great look. Shoutout to “The Wiz” in the chat for posting the idea. Going to stalk it out.

WULF (Daily)

Still long from $6.90 on the gap up day. Holding the HVC (High Volume Close) of $8.71 and building out. IREN CIFR HUT also looking and acting great. Not a crypto miner but now a true datacenter stock. GOOGL with double digit % stake in WULF. Cannot sleep on this. Tightening under $10 treating it like a Livermore $100 level. Excited and surprised this isn’t getting the attention it deserves on the internet.

ZETA (Daily)

HVC at $20.23. Volume has steadily increased since June. Remounted all MAs, 50SMA about to cross over the 200SMA. Tight inside day below breakout spot. Checks a lot of boxes here.

HNGE (Daily)

Double inside days and riding the 20EMA. Reminds me of early days of NBIS chart back in Q4 2024.

Broader Watchlist - AAOI AEHR AEO AFRM ALAB ALB ALTS AMSC AMZN ANET APP AS ASTS ATMU BA BABA BBBY BE BROS CDNS CHWY CLF COUR CRCL CRDO CRWD CRWV DDOG DKNG DLO ELF FSLR FUTU HNGE HUT INTC KC LAR LASR LC LEU LMND LYFT MDB META METC MGNI MP MU NBIS NET NFLX NIO NTRA NXT OPEN OSCR PAY PGY PL PSKY PSTG RBRK RDDT RKLB RKT SE SEDG SERV SHOP SNOW SOUN SYM TEM TLN TLRY TLS TMDX U UNH VERI VITL VNET WB WULF XMTR ZETA ZM ZS

This is the list I scan throughout the day and choose my focus list from after hours or premarket news and 3-4 from this list that are IN PLAY that day for action. This is meant to be scanned and pick out a select FOCUS list of actionable trade opportunities.

Closing Comments and Mindset

Interesting setup here going into the next few weeks. A lot, A LOT of stocks look attractive and set up while the QQQ SMH BTC look challenging. The IWM/QQQ divergence as well as ARKK and other ETFs explain it but it does make for some choppy waters generally given the weightings of the indexes. My general rule is letting my watchlist and ideas lead my way, then my recent trades and performance, and then the indexes in that order. Could be bearish kicker candle into a period that may warrants lesser participation or it could be a whole lot of nothing that gets resolved by mid week. For now, let’s watch the stocks, define our stops, and be ready to rock. It is a short week of trading with only four days of action and the end of summer also! Overall, remain incredibly optimistic and ready to involve myself where and when I can. Keeping my foot on the gas until the market screams to slow down, not just a squeal, or even a minor wince or whimper like Friday really.

BEST SUNDAY SCANS EVERY SINGLE WEEK! A MUST READ!

Thanks for sharing!